Finance Login In the digital age, the landscape of financial management has undergone a profound transformation, with technology reshaping the way individuals and businesses interact with financial institutions. At the heart of this evolution lies the concept of finance logins, which serve as the virtual keys granting access to a world of financial services and information.

Finance logins, also known as online account logins, provide users with the ability to securely access their financial accounts via digital platforms. Whether it’s checking bank balances, monitoring investment portfolios, or managing insurance policies, finance logins offer a centralized gateway for users to view account information, execute transactions, and conduct financial operations remotely.

The application of finance login in business spans various aspects of financial management and operations. Firstly, it enables businesses to monitor their financial performance in real-time. Through finance login portals, businesses can track account balances, review transaction histories, and analyze cash flow trends instantly.

This real-time visibility into financial data empowers businesses to make informed decisions, identify areas for improvement, and optimize financial strategies accordingly. The significance of finance logins extends beyond mere convenience. They empower users to take control of their financial affairs, offering unparalleled accessibility to account information and transactional capabilities 24/7.

With just a few clicks or taps, users can log in to their financial accounts from the comfort of their homes or on the go, using various devices such as computers, smartphones, or tablets. Moreover, finance logins streamline financial management by providing users with a comprehensive view of their financial holdings and activities.

Through a single login portal, users can access a wealth of information, including account balances, transaction histories, statements, and investment performance. This holistic perspective enables users to track their financial health, identify trends, and make informed decisions regarding budgeting, saving, investing, and debt management.

Beyond accessing account information, finance logins facilitate a wide array of financial transactions, ranging from fund transfers and bill payments to investment trades and loan applications. This seamless integration of transactional capabilities empowers users to manage their finances proactively and execute transactions promptly to meet their financial obligations and goals.

As we navigate the digital realm of finance logins, users need to remain vigilant and exercise caution to protect their personal and financial information. This entails safeguarding login credentials, avoiding public Wi-Fi networks when accessing financial accounts, and staying informed about emerging cybersecurity threats and best practices.

Read Also: Application of Finance Login

How to Apply Finance Login to Your Business

Applying finance login to your business involves implementing the necessary tools and processes to leverage online account access for efficient financial management and operations. Here is a step-by-step guide on how to apply finance login to your business:

1. Select a Suitable Finance Login Platform: Begin by choosing a finance login platform such as Honda finance login, Hyundai finance login, Kia finance login, Mariner finance login, Nissan finance login, Toyota finance login, and so on, that aligns with your business needs and requirements. Consider factors such as user interface, features, security measures, integration capabilities, and scalability when evaluating potential options.

2. Set Up Online Accounts: Once you’ve selected a finance login platform, set up online accounts for your business with relevant financial institutions, including banks, credit card providers, lenders, and investment firms. Follow the registration process provided by each institution to create secure login credentials for accessing your accounts online.

3. Ensure Security Measures: Prioritize security when setting up finance logins for your business. Choose strong, unique passwords for each online account and enable additional security features such as multi-factor authentication, biometric verification, and security questions. Educate employees on best practices for password management and online security to minimize the risk of unauthorized access or data breaches.

4. Integrate with Financial Management Software: If applicable, integrate finance login accounts with your chosen financial management software or accounting system. This integration streamlines data entry, automates transaction recording, and facilitates seamless synchronization of financial data between online accounts and your internal financial systems.

5. Establish Access Controls: Define access controls and permissions for employees who will be using finance login accounts for business purposes. Assign roles and responsibilities based on job functions and ensure that only authorized personnel have access to sensitive financial information or transactional capabilities.

6. Train Employees: Provide training and guidance to employees on how to use finance login platforms effectively and securely. Educate them on the features and functionalities of the platform, as well as best practices for online account management, transaction processing, and security protocols.

7. Monitor and Review Activity: Regularly monitor and review activity within finance login accounts to detect any suspicious or unauthorized transactions. Implement alert notifications and reporting mechanisms to flag unusual account activity and investigate potential security incidents promptly.

8. Optimize Financial Processes: Leverage finance login accounts to optimize financial processes and workflows within your business. Explore features such as automated payments, recurring billing, fund transfers, and electronic invoicing to streamline transaction management, reduce manual tasks, and improve efficiency.

9. Utilize Reporting and Analysis Tools: Take advantage of reporting and analysis tools provided by finance login platforms to gain insights into your business’s financial performance. Generate customized reports, analyze trends, and identify opportunities for cost savings, revenue growth, and operational improvement based on actionable data.

10. Stay Updated and Evolve: Stay informed about updates, enhancements, and new features introduced by your finance login platform and financial institutions. Continuously evaluate and evolve your approach to leveraging finance login for your business to adapt to changing needs, technology advancements, and industry trends.

By following these steps and applying finance login effectively to your business, you can enhance financial management, streamline operations, and achieve greater control and visibility over your company’s finances.

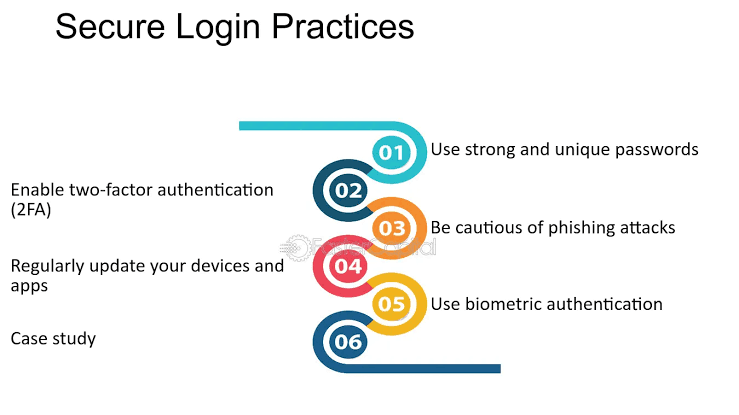

Step-By-Step Guide on How to Secure Your Finance Login Accounts

Securing your finance login account is essential to protect your financial information and prevent unauthorized access. Here is a step-by-step guide on how to secure your finance login account effectively:

1. Choose Strong Passwords: Select a strong and unique password for your finance login account. Use a combination of upper and lower case letters, numbers, and special characters. Avoid using easily guessable passwords like “password” or “123456”.

2. Enable Two-Factor Authentication (2FA): Many finance login platforms offer two-factor authentication (2FA) as an additional layer of security. Enable 2FA for your finance login account to require a second form of verification, such as a code sent to your phone, in addition to your password.

3. Update Regularly: Keep your finance login account updated with the latest security patches and updates. Ensure your operating system, web browser, and any finance login apps are up-to-date to protect against known vulnerabilities.

4. Use Secure Connections: Only access your finance login account over secure connections. Avoid logging in from public Wi-Fi networks or unsecured connections, as they may expose your login credentials to potential attackers. Use a virtual private network (VPN) for added security when accessing your account remotely.

5. Beware of Phishing Attempts: Be cautious of phishing attempts that may try to trick you into revealing your login credentials. Avoid clicking on suspicious links or downloading attachments from unknown sources. Verify the legitimacy of any communication before providing login credentials or personal information.

6. Monitor Account Activity: Regularly monitor your finance login account for any suspicious or unauthorized activity. Review your account statements and transaction history for any discrepancies. Set up alerts for unusual account activity to receive notifications of potential security threats.

7. Protect Your Devices: Ensure the devices you use to access your finance login account are secure. Use up-to-date antivirus software and firewalls to protect against malware and other security threats. Keep your devices locked with a strong password or biometric authentication.

8. Secure Your Email: Your email account is often used for password recovery and communication from your finance login provider. Secure your email account with a strong password and enable 2FA if available. Be cautious of phishing emails targeting your email account.

9. Use Secure Backup Methods: If your finance login platform offers backup methods for account recovery, such as security questions or backup codes, ensure they are set up securely. Choose unique security questions and store backup codes in a secure location.

10. Educate Yourself: Stay informed about common security threats and best practices for securing your finance login account. Educate yourself on how to recognize phishing attempts and other security risks. Regularly review security resources provided by your finance login provider.

Read Also: Reasons Why You Should Venture Into Affiliate Marketing

What Are The Leverages in Finance Login

In the realm of finance login, leveraging refers to the strategic use of online account access and associated tools and features to optimize financial management and operations. Here are several leverages inherent in finance login:

1. Convenience and Accessibility: Finance login provides businesses with convenient access to their financial accounts anytime, anywhere, through secure online portals. This accessibility enables businesses to monitor account activity, conduct transactions, and manage finances remotely, saving time and effort compared to traditional banking methods.

2. Real-Time Information: With finance login, businesses gain access to real-time financial information, including account balances, transaction histories, and cash flow data. This real-time visibility allows businesses to make informed decisions promptly, respond to financial challenges or opportunities swiftly, and maintain better control over their financial affairs.

3. Streamlined Transaction Management: Finance login streamlines transaction management for businesses by providing tools and features for initiating and processing financial transactions efficiently. Businesses can transfer funds between accounts, pay bills, authorize payments to vendors, and manage payroll seamlessly through online banking platforms or financial management software, reducing manual effort and administrative overhead.

4. Enhanced Security: Finance login platforms prioritize security to protect sensitive financial information and transactions. Leveraging advanced encryption, multi-factor authentication, and fraud detection mechanisms, businesses can safeguard their online accounts from unauthorized access, identity theft, and fraudulent activity, enhancing security and instilling confidence in online financial interactions.

5. Comprehensive Financial Reporting and Analysis: Finance login enables businesses to generate comprehensive financial reports and perform in-depth analysis of financial data. By accessing account information through finance login portals, businesses can produce balance sheets, income statements, cash flow statements, and other financial reports to assess performance, identify trends, and derive actionable insights for strategic decision-making and business growth.

6. Integration with Financial Management Software: Many finance login platforms integrate seamlessly with financial management software systems, allowing businesses to streamline financial processes and improve efficiency. By automating data synchronization between online accounts and internal financial systems, businesses can reduce manual data entry errors, enhance accuracy, and optimize workflow integration, leveraging technology to drive operational excellence.

7. Cost Savings and Efficiency Gains: Overall, leveraging finance login results in cost savings and efficiency gains for businesses. By eliminating the need for physical visits to banks or financial institutions, reducing manual administrative tasks, and optimizing financial processes, businesses can lower operational costs, improve resource utilization, and achieve greater efficiency in financial management and operations.

8. Remote Collaboration and Decision-Making: Finance login facilitates remote collaboration among stakeholders involved in financial decision-making. Business owners, finance teams, and external advisors can access financial information and collaborate on financial strategies and decisions from anywhere with internet access, improving decision-making agility and responsiveness to changing business conditions.

In conclusion, by leveraging the benefits inherent in finance login, businesses can optimize financial management, streamline operations, enhance security, and drive sustainable growth and success in today’s dynamic business environment.

Read Also: What Lifestyle Choices Can Help Reduce the Risk of Suicide?