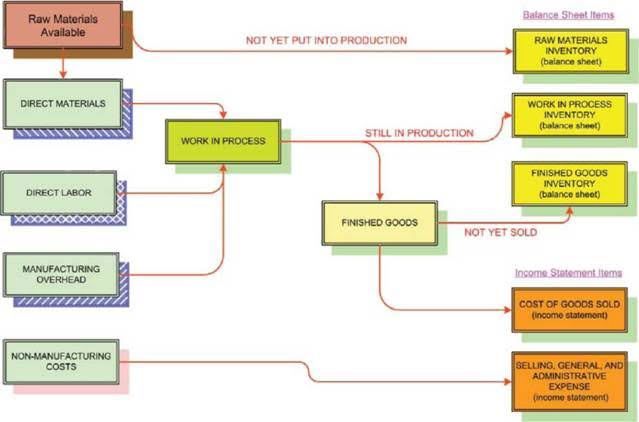

Cost of Goods Manufactured (COGM) is a crucial metric that offers insights into the total expenses incurred to transform raw materials into finished goods during a specific accounting period.

Cost of goods manufactured serves as a fundamental component of the broader cost accounting framework, providing valuable insights into the cost structure of a manufacturing operation. Cost of goods manufactured refer to various expenses incurred throughout the manufacturing journey, including direct materials, direct labor, and manufacturing overhead.

Direct materials encompass the cost of raw materials and components directly consumed in the production process, while direct labor represents the wages and benefits paid to workers directly involved in manufacturing activities. Manufacturing overhead comprises indirect costs such as factory rent, utilities, depreciation, and maintenance expenses.

The significance of cost of goods manufactured extends beyond mere financial reporting; it serves as a critical tool for decision-making and performance evaluation within manufacturing enterprises. It plays a pivotal role in accurately determining the cost of goods sold (COGS) reported on the income statement, facilitating variance analysis, pricing decisions, and profitability analysis.

Understanding the cost structure through cost of good manufactured enables businesses to set competitive pricing strategies, establish pricing benchmarks, and allocate resources effectively. Additionally, it serves as a cornerstone for budgeting and cost control efforts, enhancing operational efficiency, maximizing resource utilization, and fostering financial stability.

By analyzing cost of goods manufactured, businesses can assess the efficiency of their manufacturing processes, identify opportunities for optimization, and drive continuous improvement initiatives. This proactive approach to cost management enables businesses to adapt to changing market conditions, sustain long-term growth, and thrive in today’s dynamic business environment.

Read Also: The Benefits of Sporting Goods: A Comprehensive Guide

Understanding the Components of Cost of Goods Manufactured

The Cost of Goods Manufactured (COGM) serves as a vital metric in the realm of manufacturing, providing insights into the total expenses incurred during the production process within a specific accounting period. To grasp the intricacies of cost of goods manufactured fully, it’s essential to delve into its components and operations.

1. Direct Materials Cost: Direct materials cost encompasses the expenses associated with the raw materials and components directly used in the manufacturing process. These materials form the building blocks of the final product and contribute significantly to its overall cost. Direct materials costs may include the purchase price of raw materials, freight charges, handling fees, and any other expenses directly attributable to acquiring materials for production.

Managing direct materials costs efficiently is essential for controlling overall production expenses and ensuring product quality. Businesses must strike a balance between sourcing high-quality materials to meet product specifications and minimizing costs to maintain competitiveness in the market.

2. Direct Labor Cost: Direct labor cost represents the wages and benefits paid to employees directly involved in the manufacturing process. These workers are engaged in tasks such as assembling, fabricating, or producing goods, contributing their skills and labor to transform raw materials into finished products. Direct labor costs may include salaries, wages, overtime pay, payroll taxes, and employee benefits for production workers.

Optimizing direct labor costs involves maximizing workforce productivity, minimizing idle time, and ensuring efficient utilization of labor resources. Training and skill development initiatives can enhance employee performance and efficiency, ultimately leading to cost savings and improved production outcomes.

3. Manufacturing Overhead: Manufacturing overhead comprises indirect costs associated with the production process that cannot be directly traced to specific units of output. These overhead expenses are essential to support manufacturing operations but do not directly contribute to the physical production of goods.

Examples of manufacturing overhead include factory rent, utilities, depreciation of manufacturing equipment, maintenance costs, and indirect labor expenses. Managing manufacturing overhead effectively requires careful budgeting, cost allocation, and overhead absorption strategies.

Businesses must allocate overhead costs to products accurately to ensure that each unit’s cost reflects the full burden of manufacturing operations. By optimizing overhead expenses and improving cost efficiency, companies can enhance profitability and competitiveness in the marketplace.

4. Beginning Work-in-Progress Inventory: Beginning work-in-progress inventory represents the value of unfinished goods from the previous accounting period that are still in progress at the beginning of the current period. These partially completed goods carry over costs from the prior period and are included in the calculation of cost of goods manufactured to ensure that all production costs are accounted for in the current period’s manufacturing expenses.

Including beginning work-in-progress inventory in cost of goods manufactured ensures that costs incurred in the previous period are appropriately allocated to the current period’s production activities. This ensures consistency and accuracy in cost accounting practices, providing a clear picture of total manufacturing costs incurred during the accounting period.

5. Ending Work-in-Progress Inventory: Ending work-in-progress inventory represents the value of partially completed goods at the end of the current accounting period. These unfinished goods are still in the process of being manufactured and have not yet been completed or transferred to finished goods inventory for sale. Ending work-in-progress inventory is subtracted from cost of goods manufactured to determine the cost of goods completed during the period.

Analyzing ending work-in-progress inventory allows businesses to assess production efficiency, identify bottlenecks, and track progress towards completing manufacturing orders. By managing work-in-progress inventory effectively, companies can minimize production delays, optimize resource utilization, and improve overall operational performance.

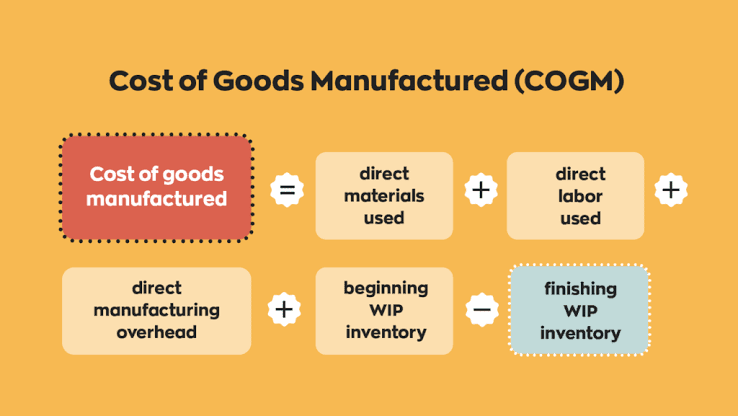

The formula for Calculating Cost of Goods Manufactured and Example

The Cost of Goods Manufactured (COGM) is a critical financial metric used by manufacturing companies to determine the total cost incurred in producing goods during a specific period. It includes direct materials, direct labor, and manufacturing overhead costs. The formula for calculating cost of goods manufactured is:

[ COGM = DM + DL + MOH + B_WIP – E_WIP ]

Where:

- DM = Direct Materials

- DL = Direct Labor

- MOH = Manufacturing Overhead

- B_WIP = Beginning Work in Process Inventory

- E_WIP = Ending Work in Process Inventory

Let’s break down each component:

1. Direct Materials (DM): Direct materials are the raw materials that are directly used in the production process. These are the tangible components that can be easily traced to the finished product. Examples include wood in furniture manufacturing or steel in automobile manufacturing. To calculate direct materials cost, multiply the quantity of materials used by their unit cost.

2. Direct Labor (DL): Direct labor refers to the wages paid to workers who directly work on the production of goods. This includes the labor costs associated with assembling, crafting, or manufacturing the products. Direct labor costs are calculated by multiplying the number of hours worked by the wage rate per hour.

3. Manufacturing Overhead (MOH): Manufacturing overhead includes all indirect manufacturing costs incurred during the production process. These costs cannot be directly traced to specific units of production. Examples of manufacturing overhead costs include rent for the factory, utilities, depreciation of machinery, and indirect labor costs. To calculate manufacturing overhead, add up all overhead costs incurred during the period.

4. Beginning Work in Process Inventory (B_WIP): The beginning work in process inventory represents the value of partially completed goods from the previous accounting period. It includes the costs of materials, labor, and overhead that were incurred but not yet completed at the beginning of the current period.

5. Ending Work in Process Inventory (E_WIP): The ending work in process inventory represents the value of partially completed goods at the end of the current accounting period. Similar to the beginning work in process inventory, it includes the costs of materials, labor, and overhead associated with partially completed goods.

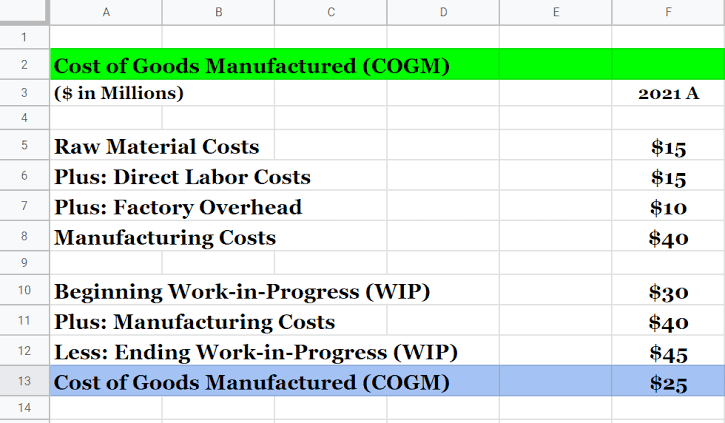

Now, let’s illustrate the calculation of cost of goods manufactured with an example:

Example:

ABC Manufacturing Company produces custom-made furniture. During the month of March 2024, the company incurred the following costs:

- Direct Materials: $50,000

- Direct Labor: $30,000

- Manufacturing Overhead: $20,000

- Beginning Work in Process Inventory: $10,000

- Ending Work in Process Inventory: $8,000

Using the formula for COGM, we can calculate:

[ COGM = DM + DL + MOH + B_WIP – E_WIP ]

Substituting the given values:

[ COGM = $50,000 + $30,000 + $20,000 + $10,000 – $8,000 ]

[ COGM = $102,000 ]

Therefore, the Cost of Goods Manufactured for March 2024 is $102,000.

Read Also: Step-By-Step Guide to Using Apple Pay at a Store

The Impact of Cost Of Goods Manufactured on Financial statement

The Cost of Goods Manufactured (COGM) is a crucial element in a company’s financial statements, impacting various aspects of financial reporting and performance analysis. It reflects the total cost incurred in the production of goods during a specific period, encompassing direct materials, direct labor, and manufacturing overhead. The impact of on financial statements can be observed in several key areas:

1. Income Statement: Cost of goods manufactured directly influences the cost of goods sold (COGS) figure on the income statement. Cost of goods sold represents the direct costs associated with producing the goods sold by a company. It is calculated by subtracting the ending inventory from the sum of beginning inventory and cost of goods manufactured.

A higher cost of goods manufactured results in a higher cost of goods sold, which reduces gross profit and, consequently, net income. Conversely, a lower cost of goods manufactured leads to a lower cost of goods sold, potentially increasing gross profit and net income.

2. Balance Sheet: Cost of goods manufactured impacts the balance sheet through its effect on inventory accounts. The finished goods inventory account reflects the cost of completed products ready for sale, which includes the cost of goods manufactured.

An increase in cost of goods manufactured leads to an increase in finished goods inventory, while a decrease in cost of goods manufactured reduces finished goods inventory. Similarly, the work in process (WIP) inventory account reflects the cost of partially completed goods.

Beginning and ending WIP inventory balances are included in the cost of goods manufactured calculation. Thus, changes in cost of goods manufactured directly affect the balances of finished goods and WIP inventory accounts on the balance sheet.

3. Inventory Valuation: The valuation of inventory on the balance sheet is impacted by cost of goods manufactured. Generally, inventory is recorded at the lower of cost or market value. cost of goods manufactured contributes to the cost basis of inventory, ensuring that inventory is reported at its historical cost. This valuation principle ensures that inventory is not overstated on the balance sheet, which could distort financial performance metrics and ratios.

4. Cost of Goods Sold Analysis: cost of goods manufactured is also used to analyze the components of cost of goods sold and their trends over time. By comparing cost of goods manufactured to previous periods or industry benchmarks, management can identify changes in the cost structure of production.

For example, an increase in cost of goods manufactured relative to sales revenue may indicate higher production costs or inefficiencies in manufacturing processes. Conversely, a decrease in cost of goods manufactured may suggest cost-saving measures or improved operational efficiency.

5. Gross Profit Margin: Gross profit margin, calculated as gross profit divided by revenue, is a key profitability metric influenced by cost of goods manufactured. A higher cost of goods manufactured, resulting in higher cost of goods sold, reduces gross profit margin, indicating lower profitability per unit sold.

Conversely, a lower cost of goods manufactured increases gross profit margin, signaling improved cost efficiency and profitability. Monitoring gross profit margin helps assess the effectiveness of cost management strategies and production processes.

6. Investor and Stakeholder Perception: Investors and stakeholders closely monitor cost of goods manufactured and its impact on financial statements as it provides insights into the company’s operational efficiency and cost management practices.

A company with consistently high cost of goods manufactured relative to sales revenue may face scrutiny regarding its ability to control production costs and maintain profitability. Conversely, a company that effectively manages cost of goods manufactured to achieve lower production costs may be viewed favorably by investors and stakeholders.

In conclusion, the Cost of Goods Manufactured (COGM) plays a fundamental role in financial reporting and performance analysis for manufacturing companies. It influences key financial statements such as the income statement and balance sheet, affecting metrics such as cost of goods sold, inventory valuation, and gross profit margin.

By analyzing cost of goods manufactured and its impact on financial statements, management can assess operational efficiency, identify cost-saving opportunities, and make informed decisions to enhance profitability and shareholder value.

Read Also: How to Get Into College