Motor Finance refers to the financial arrangements made to facilitate the purchase or lease of vehicles. It allows individuals to acquire vehicles without having to make large upfront payments by spreading the cost over a specified period. Motor Finance typically involves lenders providing loans or lease agreements to consumers, enabling them to drive their desired vehicles while making regular payments.

Motor Finance plays a crucial role in the vehicle acquisition process, streamlining transactions and broadening access to car ownership. Among the prominent players in this field, Kia, Subaru, and Hyundai stand out for their commitment to offering tailored financing solutions that cater to the diverse needs of consumers.

Kia Finance, for instance, distinguishes itself with its competitive rates and flexible terms, empowering customers to customize their financing arrangements according to their budget and lifestyle preferences. With a range of options including lease agreements and traditional auto loans, Kia Finance ensures that individuals can select the most suitable option for their needs.

Similarly, Subaru Finance prioritizes customer satisfaction and transparency by providing straightforward financing terms and competitive rates. Whether customers are purchasing a new or used vehicle, Subaru Finance offers flexible financing solutions designed to simplify the decision-making process and meet their financial needs.

Hyundai Finance, on the other hand, is known for its innovative approach to financing solutions, offering a variety of options to make vehicle ownership accessible to everyone. From low-interest loans to lease agreements with attractive terms, Hyundai Finance caters to a wide range of budgets and lifestyles, ensuring that customers have the flexibility to choose the option that best fits their needs.

In addition to their competitive rates and flexible terms, Kia, Subaru, and Hyundai Finance offer a range of supplementary benefits to their customers. These benefits include special financing offers, extended warranty options, online account management tools, and excellent customer service.

Special financing offers, such as zero percent APR or cashback incentives, are frequently rolled out by these providers to entice customers and make vehicle ownership even more affordable. Extended warranty options provide customers with peace of mind, protecting their investment and safeguarding against unexpected repair costs.

Online account management tools offered by Kia, Subaru, and Hyundai Finance enable customers to easily access their account information, make payments, and view statements from the comfort of their own home. This convenience enhances the overall customer experience and streamlines the management of their financing arrangements.

Excellent customer service is a cornerstone of Kia, Subaru, and Hyundai Finance, with knowledgeable representatives available to assist customers throughout the financing process. Whether customers have questions about their financing options or need assistance with their account, they can expect prompt and helpful service from these providers.

Read Also: Guide on How to Start a Coffee Shop

What are the Different Types of Motor Finance

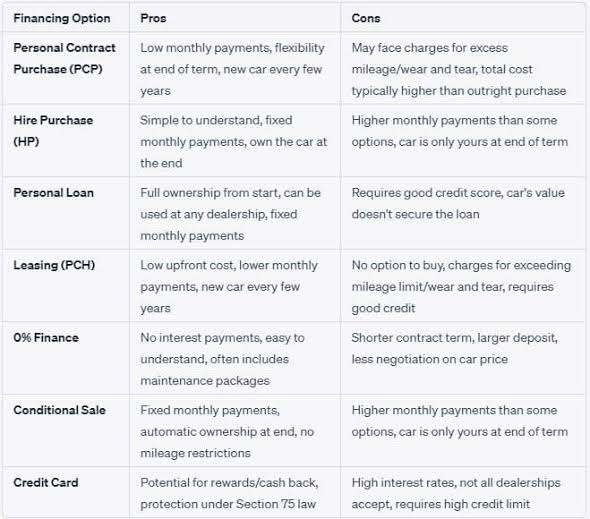

Motor finance encompasses various financing options tailored to meet the diverse needs of consumers. These options enable individuals to acquire vehicles without needing to make large upfront payments, thereby broadening access to car ownership. Here are the different types of motor finance available:

1. Hire Purchase (HP): Hire Purchase is a common form of motor finance where the buyer pays an initial deposit, followed by fixed monthly installments over an agreed-upon period. Once all payments are made, ownership of the vehicle is transferred to the buyer. This option provides budgetary certainty as the monthly payments remain fixed throughout the term.

2. Personal Contract Purchase (PCP): PCP is a flexible financing option that offers lower monthly payments compared to traditional loans. With PCP, the buyer pays an initial deposit and then makes monthly payments over the contract term. At the end of the term, the buyer has the option to return the vehicle, trade it in for a new one, or pay a final balloon payment to take ownership of the vehicle outright.

3. Leasing: Vehicle leasing involves renting a car for an agreed-upon period, typically two to four years, with fixed monthly payments. Unlike hire purchase or PCP, the lessee does not have the option to buy the vehicle at the end of the lease term. Instead, they return the vehicle to the leasing company, which retains ownership.

4. Personal Loans: Consumers can also finance vehicle purchases through personal loans obtained from banks, credit unions, or online lenders. With a personal loan, the borrower receives a lump sum of money upfront and repays it, plus interest, over a specified period. Personal loans offer flexibility as they can be used to finance both new and used vehicles, and the buyer owns the vehicle outright from the outset.

5. Manufacturer Finance: Many car manufacturers offer their own financing options, often with competitive interest rates and special promotions. These financing arrangements may include hire purchase, PCP, or leasing options tailored to the manufacturer’s specific models and customer base. Manufacturer finance deals may also include extras such as extended warranties or servicing packages.

6. Dealer Finance: Car dealerships often have relationships with finance companies and can arrange financing for their customers on-site. Dealer finance options may include hire purchase, PCP, or leasing agreements, and dealers may offer promotions such as zero-percent finance or cashback incentives to attract buyers.

7. Credit Cards: While less common, some consumers may choose to finance vehicle purchases using credit cards. This option is typically reserved for smaller purchases or as a short-term financing solution. Credit card financing may offer benefits such as rewards points or cashback, but it’s important to consider the high-interest rates and potential impact on credit scores.

8. Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual investors willing to fund loans. Consumers can apply for vehicle financing through peer-to-peer lending platforms, potentially securing more favorable terms than traditional lenders. Peer-to-peer lending may offer lower interest rates and more flexible repayment options.

What to Consider Before Choosing Motor Finance

When considering motor finance options, consumers are faced with a multitude of choices that can have long-term implications for their financial well-being. Before committing to a financing arrangement, it’s essential to carefully evaluate various factors to ensure the best possible outcome.

1. Understanding Different Financing Options: One of the first considerations when choosing motor finance is understanding the different financing options available. From hire purchase and personal contract purchase to leasing, personal loans, manufacturer finance, dealer finance, and credit cards, each option comes with its own set of terms, conditions, and implications. It’s essential to research and compare these options to determine which best aligns with your financial situation and preferences.

2. Assessing Affordability: Before committing to motor finance, it’s crucial to assess affordability and determine how much you can comfortably afford to borrow and repay. Consider factors such as your income, expenses, and other financial obligations to ensure that the monthly payments fit within your budget. Use online calculators or consult with financial advisors to determine the affordability of various financing options.

3. Evaluating Total Cost of Ownership: In addition to monthly payments, it’s essential to consider the total cost of ownership over the life of the financing arrangement. This includes factors such as interest charges, fees, taxes, insurance premiums, maintenance costs, and depreciation. By evaluating the total cost of ownership, you can make an informed decision and avoid any surprises down the line.

4. Reviewing Terms and Conditions: Before signing a motor finance agreement, carefully review the terms and conditions to understand the rights, responsibilities, and obligations of both parties. Pay attention to key terms such as interest rates, loan duration, repayment schedule, early repayment penalties, and any additional fees or charges. If anything is unclear, don’t hesitate to seek clarification from the lender or finance provider.

5. Considering Flexibility and Exit Options: Flexibility is another important consideration when choosing motor finance. Evaluate whether the financing arrangement offers flexibility in terms of repayment options, early repayment, or termination of the agreement.

For example, personal contract purchase (PCP) agreements often provide flexibility at the end of the term, allowing you to choose between returning the vehicle, purchasing it outright, or entering into a new agreement.

6. Checking Creditworthiness and Eligibility: Before applying for motor finance, it’s essential to check your creditworthiness and eligibility for financing. Lenders typically assess factors such as credit score, income, employment history, and debt-to-income ratio when determining eligibility for financing and interest rates. Review your credit report and address any issues or discrepancies before applying for motor finance to improve your chances of approval and secure favorable terms.

7. Seeking Competitive Offers and Negotiating: Don’t settle for the first motor finance offer you receive. Shop around and compare offers from multiple lenders to find the most competitive rates and terms. Additionally, don’t be afraid to negotiate with lenders to secure better terms or incentives. By being proactive and assertive, you may be able to save money and secure a more favorable financing arrangement.

8. Seeking Professional Advice: If you’re unsure about which motor finance option is best for you, consider seeking professional advice from financial advisors or consultants. They can help you assess your financial situation, evaluate various financing options, and make informed decisions based on your individual needs and circumstances.

Read Also: What You Need to Know About Honda Finance

Impact of Motor Finance on the Automotive Industry

Motor finance plays a significant role in shaping the automotive industry, impacting various stakeholders including manufacturers, dealerships, consumers, and the economy as a whole.

1. Stimulating Vehicle Sales: Motor finance facilitates vehicle sales by providing consumers with accessible financing options. Many individuals may not have the financial means to purchase a vehicle outright, but motor finance allows them to spread the cost over time through loans, leases, or other financing arrangements. This accessibility stimulates demand for vehicles, driving sales for automotive manufacturers and dealerships.

2. Supporting Automotive Manufacturers: The availability of motor finance supports automotive manufacturers by increasing the pool of potential buyers for their vehicles. By offering financing options tailored to different consumer segments, manufacturers can attract a wider range of customers and increase their market share. Additionally, motor finance provides manufacturers with a steady stream of revenue from interest payments and financing fees.

3. Enhancing Dealership Profitability: Motor finance contributes to dealership profitability by enabling them to offer financing solutions to their customers. Dealerships often have relationships with finance companies and can arrange financing on behalf of their customers, earning commissions or other incentives in the process. By providing financing options, dealerships can close more sales and generate additional revenue.

4. Driving Innovation in Financing Products: The competitive nature of the motor finance industry drives innovation in financing products and services. Motor finance providers continuously develop new financing solutions to meet the evolving needs of consumers and differentiate themselves from competitors. This innovation may include features such as online account management tools, extended warranty options, and loyalty programs, enhancing the overall customer experience.

5. Creating Jobs and Economic Activity: The motor finance industry contributes to job creation and economic activity through its impact on the automotive sector. Financing companies employ staff in various roles, including sales, underwriting, customer service, and administration. Additionally, increased vehicle sales resulting from motor finance stimulate economic activity in related industries, such as manufacturing, transportation, and retail.

6. Managing Financial Risks: While motor finance offers benefits to consumers and industry players, it also involves financial risks that must be managed effectively. Lenders face risks such as default on loan payments, depreciation of vehicle collateral, and changes in interest rates. Effective risk management strategies, including credit scoring, loan underwriting, and portfolio diversification, are essential to mitigate these risks and ensure the stability of the motor finance industry.

7. Adapting to Regulatory Changes: The motor finance industry operates within a regulatory framework governed by laws and regulations designed to protect consumers and ensure fair and transparent lending practices. Motor finance providers must stay abreast of regulatory changes and adapt their practices accordingly to remain compliant. This may involve implementing new procedures, updating disclosure requirements, or adjusting pricing strategies in response to regulatory mandates.

8. Promoting Sustainable Transportation: Motor finance can play a role in promoting sustainable transportation practices by incentivizing the purchase of fuel-efficient or electric vehicles. Some financing companies offer special financing rates or incentives for eco-friendly vehicles, encouraging consumers to make environmentally conscious choices. This aligns with broader societal goals of reducing carbon emissions and mitigating climate change.

In conclusion, motor finance has a profound impact on the automotive industry, influencing vehicle sales, supporting manufacturers and dealerships, driving innovation, creating jobs, managing financial risks, adapting to regulatory changes, and promoting sustainable transportation practices.

By providing accessible financing options to consumers, motor finance plays a crucial role in enabling vehicle ownership and driving economic activity in the automotive sector. However, it is essential for industry players to manage risks effectively, comply with regulations, and promote responsible lending practices to ensure the long-term sustainability and stability of the motor finance industry.

Read Also: Places to Visit in Africa For Holidays