A finance forecast is an essential tool used by businesses, organizations, and governments to project future financial performance based on historical data, current economic conditions, and anticipated market trends. It involves predicting revenues, expenses, profits, and cash flows over a specific period, which helps in strategic planning, budgeting, and decision-making processes.

The primary objective of a financial forecast is to provide a roadmap that guides an organization toward its financial goals, ensuring it remains solvent, competitive, and able to capitalize on opportunities or mitigate potential risks. Financial forecasting relies on both quantitative and qualitative data.

Quantitative data includes historical financial statements, such as income statements, balance sheets, and cash flow statements. Analysts use this data to identify trends and patterns that can inform future projections. Qualitative data, on the other hand, encompasses broader economic indicators, industry analyses, and insights into market conditions.

This might include information about regulatory changes, technological advancements, consumer behavior, and competitive dynamics. The process of financial forecasting begins with data collection and analysis. Historical financial data is gathered to establish a baseline understanding of the organization’s performance.

This data is then analyzed to identify trends and patterns that can provide insights into future performance. For instance, an increase in sales during a particular season might indicate a pattern that could be expected to continue in the future. Similarly, recurring expenses can be projected forward to estimate future costs.

Once the historical data has been analyzed, financial models are developed to project future performance. These models can be simple or complex, depending on the needs of the organization and the availability of data. Simple models might involve straight-line projections based on historical growth rates, while more complex models might use statistical methods or machine learning algorithms to generate forecasts.

Financial models often incorporate assumptions about future conditions, such as changes in market demand, pricing strategies, cost structures, and economic conditions. These assumptions are critical because they influence the accuracy of the forecast. It is essential to base these assumptions on credible sources and thorough analysis to ensure they are realistic and relevant.

One common method used in financial forecasting is the time series analysis. This technique involves analyzing historical data points to identify trends, seasonal patterns, and cyclical fluctuations. Time series analysis helps to smooth out irregularities and predict future values based on past behavior.

Another approach is the causal model, which attempts to establish cause-and-effect relationships between different variables. For example, a causal model might examine how changes in interest rates impact consumer spending and, consequently, the organization’s revenue.

Scenario analysis is another valuable tool in financial forecasting. This method involves creating multiple forecast scenarios based on different assumptions about future conditions. For example, an organization might develop best-case, worst-case, and most likely scenarios to understand the potential range of outcomes.

Scenario analysis helps decision-makers evaluate the impact of different strategies and prepare for various contingencies. Cash flow forecasting is a crucial aspect of financial forecasting, particularly for businesses that rely on steady cash flow to operate smoothly.

Cash flow forecasts project the inflows and outflows of cash over a specified period, helping organizations ensure they have sufficient liquidity to meet their obligations. By identifying potential cash shortages or surpluses, businesses can take proactive measures, such as securing financing or adjusting spending, to maintain financial stability.

Financial forecasting is not a one-time activity but an ongoing process that requires regular updates and revisions. As new information becomes available and conditions change, forecasts need to be adjusted to reflect the latest data and assumptions.

Regularly updating financial forecasts helps organizations stay agile and responsive to emerging opportunities and challenges. It also allows for continuous improvement in the forecasting process as analysts refine their models and assumptions based on real-world outcomes.

Effective financial forecasting offers several benefits to organizations. It enhances strategic planning by providing a clear view of potential future financial performance, enabling leaders to set realistic goals and allocate resources effectively. It also improves risk management by identifying potential financial shortfalls or challenges that might arise.

By anticipating these issues, organizations can develop strategies to mitigate risks and avoid financial crises. Furthermore, financial forecasts are essential for stakeholder communication. Investors, lenders, and other stakeholders rely on financial forecasts to make informed decisions about their involvement with the organization.

Accurate and well-supported forecasts build credibility and trust, enhancing the organization’s reputation and ability to attract capital. In practice, financial forecasting involves collaboration among various departments within an organization, including finance, marketing, operations, and sales.

Each department contributes valuable insights and data that inform the overall forecast. For example, the sales team might provide information on projected sales volumes, while the operations team might offer insights into production costs and capacity constraints.

This collaborative approach ensures that the forecast is comprehensive and reflects the organization’s overall strategy and goals. Technological advancements have significantly improved the accuracy and efficiency of financial forecasting. Modern software tools and platforms enable organizations to automate data collection, analysis, and modeling processes.

These tools can handle large volumes of data and perform complex calculations quickly, reducing the time and effort required for forecasting. Additionally, advanced analytics and machine learning algorithms can identify patterns and trends that might be missed by traditional methods, enhancing the precision of forecasts.

Read Also: How to Buy the Best Harley Davidson Motorcycle Near Me

The Key Benefits of Using a Finance Forecast for Your Financial Planning

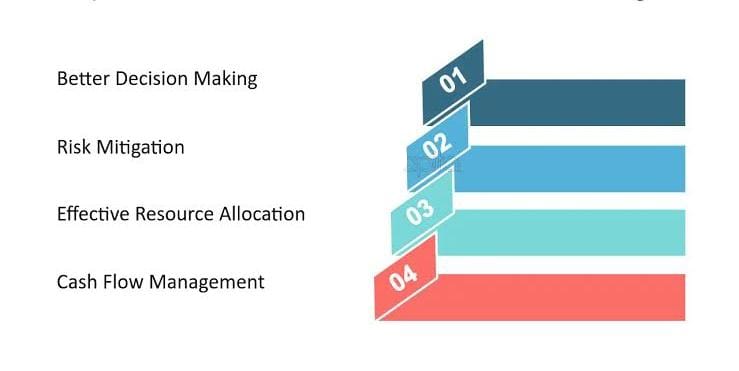

Using a finance forecast is a crucial practice in financial planning, offering a multitude of benefits that help individuals and organizations make informed decisions, manage risks, and achieve their financial goals. By projecting future financial performance based on historical data, current conditions, and anticipated trends, finance forecasts provide valuable insights that guide strategic planning and resource allocation.

1. Informed Decision-Making: One of the primary benefits of financial forecasting is that it enables informed decision-making. By projecting future revenues, expenses, profits, and cash flows, a finance forecast provides a clear picture of potential financial outcomes.

This information helps business leaders and financial managers make strategic decisions about investments, expansions, cost-cutting measures, and other critical activities. With a finance forecast, decision-makers can evaluate the potential impact of different scenarios and choose the best course of action to achieve their financial objectives.

2. Enhanced Strategic Planning: Finance forecasts are integral to the strategic planning process. They provide a roadmap for the future, allowing organizations to set realistic goals and develop plans to achieve them. By understanding projected financial performance, companies can allocate resources more effectively, prioritize initiatives, and ensure that their strategic plans are financially viable. Financial forecasts help organizations anticipate future needs and opportunities, enabling them to position themselves advantageously in the market.

3. Improved Budgeting: Budgeting is a critical component of financial planning, and finance forecasts play a key role in creating accurate and effective budgets. Forecasts provide estimates of future income and expenses, which form the basis of the budget.

By aligning the budget with projected financial performance, organizations can ensure that they have the necessary resources to meet their objectives and avoid overspending. Accurate budgets based on reliable forecasts help maintain financial discipline and control, enabling organizations to operate within their means.

4. Risk Management: Financial forecasting is an essential tool for risk management. By projecting future financial outcomes, forecasts help identify potential risks and challenges that might impact the organization. For example, a forecast might reveal potential cash flow shortages, market downturns, or cost increases.

By anticipating these risks, organizations can develop strategies to mitigate them, such as securing additional financing, diversifying investments, or adjusting operational plans. Effective risk management through financial forecasting helps protect the organization’s financial health and ensures long-term sustainability.

5. Cash Flow Management: Effective cash flow management is critical for the survival and growth of any business. Finance forecasts provide detailed projections of cash inflows and outflows, helping organizations ensure they have sufficient liquidity to meet their obligations.

By identifying potential cash flow gaps in advance, companies can take proactive measures to address them, such as adjusting payment schedules, negotiating credit terms, or arranging for short-term financing. Improved cash flow management through forecasting helps maintain operational stability and avoids financial crises.

6. Performance Monitoring: Finance forecasts serve as benchmarks for performance monitoring. By comparing actual financial results against forecasted figures, organizations can assess their performance and identify areas of improvement.

This comparison helps identify variances and understand the reasons behind them, whether they are due to changes in market conditions, operational inefficiencies, or other factors. Performance monitoring through financial forecasting enables organizations to make data-driven adjustments to their strategies and operations, enhancing overall efficiency and effectiveness.

7. Investor and Stakeholder Confidence: Accurate and well-supported financial forecasts build confidence among investors, lenders, and other stakeholders. Stakeholders rely on financial forecasts to assess the potential returns and risks associated with their investment or involvement with the organization.

By providing credible projections and demonstrating a clear understanding of future financial performance, organizations can attract and retain investors and secure necessary financing. Enhanced stakeholder confidence leads to stronger financial support and better opportunities for growth and development.

8. Facilitates Growth and Expansion: Finance forecasts are instrumental in facilitating growth and expansion. By projecting future financial performance, forecasts help organizations identify the right time to invest in new projects, enter new markets, or expand operations.

They provide insights into potential revenue streams and cost implications, enabling organizations to plan and execute growth strategies with greater precision and confidence. Effective forecasting supports sustainable growth by ensuring that expansion plans are financially viable and aligned with the organization’s long-term goals.

9. Better Resource Allocation: Efficient resource allocation is essential for maximizing organizational performance. Finance forecasts help identify the areas where resources are needed most and where they can have the greatest impact.

By projecting future financial needs, organizations can allocate resources strategically to support high-priority initiatives and optimize overall performance. Better resource allocation through financial forecasting ensures that organizations make the most effective use of their financial, human, and operational resources.

10. Compliance and Reporting: Financial forecasting supports compliance and reporting requirements. Many regulatory bodies and financial institutions require organizations to provide financial forecasts as part of their compliance and reporting obligations.

Accurate forecasts help ensure that organizations meet these requirements and maintain their good standing with regulators and financial partners. Additionally, comprehensive financial forecasts enhance internal reporting by providing management with a clear understanding of future financial performance, enabling more informed decision-making.

11. Enhanced Financial Health: Ultimately, the use of finance forecasts contributes to enhanced financial health. By providing a clear picture of future financial performance, forecasts help organizations plan effectively, manage risks, and make informed decisions that support long-term sustainability. Enhanced financial health through effective forecasting leads to greater stability, resilience, and capacity to achieve financial goals.

Read Also: Where Can I Find the Best Finance News?

How an Accurate Finance Forecast Leads to Better Decision-Making

An accurate finance forecast is an invaluable tool that significantly enhances decision-making within an organization. By predicting future financial performance based on historical data, current conditions, and anticipated trends, accurate forecasts provide a clear roadmap for planning and strategy. Here’s how an accurate finance forecast leads to better decision-making:

1. Strategic Planning: Accurate financial forecasts are crucial for effective strategic planning. By providing a detailed projection of future revenues, expenses, profits, and cash flows, forecasts enable organizations to set realistic and achievable goals. They inform long-term strategies and help align resources and efforts with the company’s vision.

For example, if a forecast predicts strong revenue growth in the coming years, a company might decide to invest in new product development or expand into new markets. Conversely, if the forecast indicates potential financial challenges, the company can proactively adjust its strategy to mitigate risks.

2. Resource Allocation: Effective resource allocation is fundamental to organizational success. Accurate finance forecasts highlight the areas where resources are most needed and can have the greatest impact. By understanding future financial requirements, organizations can allocate capital, human resources, and operational capabilities more strategically.

This ensures that high-priority projects receive the necessary support, thereby optimizing overall performance and productivity. For instance, if a forecast indicates a high return on investment in a particular department, more resources can be directed there to maximize benefits.

3. Risk Management: Financial forecasting plays a pivotal role in risk management. Accurate forecasts help identify potential risks and challenges that could impact the organization. By anticipating financial shortfalls, market downturns, or increased costs, companies can develop strategies to mitigate these risks.

This might include securing additional financing, adjusting operational plans, or diversifying investments. Proactive risk management based on reliable forecasts helps protect the organization’s financial health and ensures long-term sustainability.

4. Cash Flow Management: Effective cash flow management is essential for maintaining operational stability. Accurate forecasts provide detailed projections of cash inflows and outflows, helping organizations ensure they have sufficient liquidity to meet their obligations.

By identifying potential cash flow gaps in advance, businesses can take proactive measures, such as adjusting payment schedules, negotiating credit terms, or arranging for short-term financing. Improved cash flow management through accurate forecasting helps avoid financial crises and maintains smooth business operations.

5. Performance Monitoring: Financial forecasts serve as benchmarks for performance monitoring. By comparing actual financial results against forecasted figures, organizations can assess their performance and identify areas of improvement.

This comparison helps detect variances and understand the reasons behind them, whether they are due to changes in market conditions, operational inefficiencies, or other factors. Performance monitoring through accurate forecasting enables organizations to make data-driven adjustments to their strategies and operations, enhancing overall efficiency and effectiveness.

6. Investor and Stakeholder Confidence: Accurate and well-supported financial forecasts build confidence among investors, lenders, and other stakeholders. Stakeholders rely on financial forecasts to assess the potential returns and risks associated with their investment or involvement with the organization.

By providing credible projections and demonstrating a clear understanding of future financial performance, organizations can attract and retain investors and secure necessary financing. Enhanced stakeholder confidence leads to stronger financial support and better opportunities for growth and development.

7. Facilitates Growth and Expansion: Accurate finance forecasts are instrumental in facilitating growth and expansion. By projecting future financial performance, forecasts help organizations identify the right time to invest in new projects, enter new markets, or expand operations.

They provide insights into potential revenue streams and cost implications, enabling organizations to plan and execute growth strategies with greater precision and confidence. Effective forecasting supports sustainable growth by ensuring that expansion plans are financially viable and aligned with the organization’s long-term goals.

8. Budgeting: Budgeting is a critical component of financial planning, and accurate finance forecasts play a key role in creating effective budgets. Forecasts provide estimates of future income and expenses, which form the basis of the budget.

By aligning the budget with projected financial performance, organizations can ensure they have the necessary resources to meet their objectives and avoid overspending. Accurate budgets based on reliable forecasts help maintain financial discipline and control, enabling organizations to operate within their means.

9. Improved Decision-Making Process: The decision-making process is significantly enhanced by accurate financial forecasts. Decision-makers rely on forecasts to understand the potential financial impact of various options and scenarios.

This information helps them evaluate the pros and cons of different strategies and make informed choices that align with the organization’s goals. For example, if a forecast predicts a decline in market demand, management might decide to delay a planned investment or focus on cost reduction initiatives. Accurate forecasts provide the data-driven insights needed for sound decision-making.

10. Competitive Advantage: In a competitive business environment, having accurate financial forecasts can provide a significant advantage. By understanding future financial trends and conditions, organizations can anticipate market changes and respond more quickly and effectively than their competitors.

This might involve capitalizing on emerging opportunities, addressing potential threats, or adapting to new market dynamics. Accurate forecasting enables organizations to stay ahead of the curve and maintain a competitive edge.

11. Compliance and Reporting: Accurate financial forecasts support compliance and reporting requirements. Many regulatory bodies and financial institutions require organizations to provide financial forecasts as part of their compliance and reporting obligations.

Reliable forecasts help ensure that organizations meet these requirements and maintain their good standing with regulators and financial partners. Additionally, comprehensive financial forecasts enhance internal reporting by providing management with a clear understanding of future financial performance, enabling more informed decision-making.

12. Enhanced Financial Health: Ultimately, the use of accurate finance forecasts contributes to enhanced financial health. By providing a clear picture of future financial performance, forecasts help organizations plan effectively, manage risks, and make informed decisions that support long-term sustainability.

Enhanced financial health through accurate forecasting leads to greater stability, resilience, and capacity to achieve financial goals. Organizations that leverage accurate financial forecasting can navigate uncertainties, capitalize on opportunities, and sustain their operations in an increasingly dynamic and competitive environment.

Tips for Creating and Utilizing an Effective Finance Forecast For Financial Growth

Creating and utilizing an effective finance forecast is crucial for businesses, organizations, and individuals to plan ahead, make informed decisions, and achieve financial goals. A finance forecast projects future financial performance based on historical data, current trends, and anticipated changes, providing valuable insights into revenues, expenses, profits, and cash flows. Here are tips for creating and utilizing an effective finance forecast:

1. Define Your Objectives and Scope: Before creating a finance forecast, clearly define your objectives and scope. Determine what specific aspects of financial performance you want to forecast (e.g., revenue, expenses, cash flow) and the time horizon (e.g., monthly, quarterly, annually). Identify key stakeholders and decision-makers who will use the forecast to ensure it aligns with their needs and expectations.

2. Gather Accurate and Relevant Data: Accurate data is essential for creating a reliable finance forecast. Gather historical financial statements, including income statements, balance sheets, and cash flow statements, for the period you are forecasting. Additionally, collect relevant non-financial data that could impact financial performance, such as market trends, economic indicators, industry forecasts, and customer behavior.

3. Use Multiple Forecasting Methods: Utilize multiple forecasting methods to enhance accuracy and reliability. Common methods include:

- Time Series Analysis: Analyze historical data to identify trends, seasonal patterns, and cyclical fluctuations.

- Causal Models: Establish cause-and-effect relationships between variables (e.g., how changes in interest rates affect consumer spending).

- Regression Analysis: Identify correlations between variables to predict future outcomes.

- Scenario Analysis: Develop multiple scenarios based on different assumptions to assess potential outcomes under varying conditions.

Combining these methods can provide a comprehensive view of future financial performance and help mitigate the limitations of individual forecasting approaches.

4. Involve Cross-Functional Teams: Finance forecasts should involve input from cross-functional teams within the organization. Collaborate with departments such as sales, marketing, operations, and human resources to gather insights into future activities, market conditions, sales projections, and operational plans. Incorporating diverse perspectives ensures that the forecast reflects a holistic view of the organization’s activities and potential impacts on financial performance.

5. Validate Assumptions and Adjust for Uncertainty: Assumptions underpinning the forecast should be carefully validated and adjusted for uncertainty. Consider factors such as changes in market conditions, regulatory developments, technological advancements, and competitive dynamics.

Conduct sensitivity analysis to assess the impact of varying assumptions on forecasted outcomes and adjust projections accordingly. Addressing uncertainty helps improve the robustness of the forecast and enhances its reliability for decision-making.

6. Focus on Realistic and Achievable Goals: Set realistic and achievable goals based on the forecasted outcomes. Align financial projections with strategic objectives and operational plans to ensure coherence between financial targets and organizational priorities.

Avoid overly optimistic or pessimistic projections that may undermine credibility and effectiveness. Instead, aim for goals that challenge the organization while remaining within practical reach based on the forecasted financial performance.

7. Monitor and Update Regularly: Finance forecasts are dynamic and should be monitored and updated regularly to reflect changes in internal and external conditions. Establish a schedule for reviewing and revising forecasts based on the frequency of data updates and the pace of business activities.

Monitor actual financial performance against forecasted figures and analyze variances to understand the reasons behind deviations. Regular updates ensure that forecasts remain relevant, accurate, and aligned with current circumstances.

8. Integrate Risk Management Considerations: Integrate risk management considerations into the finance forecast to assess and mitigate potential threats to financial performance. Identify key risks, such as market volatility, operational disruptions, regulatory changes, and financial constraints, that could impact forecasted outcomes.

Develop contingency plans and alternative scenarios to address identified risks and ensure the organization is prepared to respond effectively to unforeseen challenges. By incorporating risk management into the forecast, organizations enhance resilience and maintain financial stability.

9. Communicate Effectively: Effective communication of the finance forecast is essential to ensure stakeholders understand the assumptions, methodologies, and implications of the projections. Tailor communication strategies to different audiences, such as executives, board members, investors, and employees, to convey relevant information clearly and transparently. Provide context around forecasted figures, including key drivers, potential risks, and strategic implications, to facilitate informed decision-making and garner support for financial plans.

10. Utilize Technology and Tools: Leverage technology and advanced forecasting tools to streamline the forecasting process and improve accuracy. Financial forecasting software, data analytics platforms, and predictive modeling tools can automate data collection, analysis, and scenario planning, reducing manual effort and human error.

These tools provide sophisticated forecasting capabilities, such as predictive algorithms and real-time data updates, that enhance the reliability and timeliness of forecasts. Invest in training staff on the effective use of technology to maximize the benefits of these tools for finance forecasting.

11. Seek External Expertise if Needed: Consider seeking external expertise from financial consultants, analysts, or advisory firms to enhance the quality and objectivity of the finance forecast. External experts can provide specialized knowledge, industry insights, and best practices that complement internal capabilities.

Collaborate with trusted advisors to validate assumptions, refine forecasting methodologies, and develop actionable recommendations based on forecasted outcomes. External perspectives can offer valuable perspectives and enhance the credibility of the forecast among stakeholders.

12. Learn from Past Performance: Reflect on past forecasting experiences to identify lessons learned and continuously improve forecasting practices. Evaluate the accuracy of previous forecasts, analyze factors contributing to variances between forecasted and actual results, and incorporate insights into future forecasting efforts. By learning from past performance, organizations can refine forecasting methodologies, enhance predictive accuracy, and strengthen decision-making capabilities over time.

In conclusion, creating and utilizing an effective finance forecast involves defining clear objectives, gathering accurate data, using multiple forecasting methods, involving cross-functional teams, validating assumptions, focusing on realistic goals, monitoring and updating regularly, integrating risk management considerations, communicating effectively, utilizing technology and tools, seeking external expertise if needed, and learning from past performance. By following these tips, organizations can develop robust finance forecasts that inform strategic decisions, mitigate risks, and drive sustainable financial performance.

Read Also: Comparison between E-Business vs. E-Commerce