Easypay Finance is a modern solution designed to simplify the way people handle their payments, offering a user-friendly platform for both individuals and businesses to manage transactions. Essentially, Easypay functions as a digital wallet, providing users with a convenient and secure way to store and utilize their money for various purposes.

Here is how Easypay Finance works, every user need to add money to their Easypay accounts first, and this can be done through several methods, including transferring funds from a bank account, using a credit or debit card, or even depositing cash directly into the Easypay account.

This initial step ensures that users have funds available within the platform to make payments when needed. Once the money is in the Easypay account, users gain access to a wide range of payment options. Whether it’s paying bills, shopping online, or sending money to friends and family, Easypay simplifies the payment process by providing an intuitive interface and straightforward functionality.

Users can initiate transactions with just a few clicks or taps, eliminating the need for cumbersome cash or physical cards. A significant advantage of Easypay lies in its extensive network of merchants and service providers. By partnering with businesses across various industries, Easypay ensures that users can use the platform to make payments at a multitude of establishments, both online and offline.

This widespread acceptance enhances the convenience of using Easypay, allowing users to complete transactions seamlessly wherever they go. Security is a top priority for Easypay, with robust measures in place to protect users’ financial information and personal data.

Advanced encryption technology and multi-factor authentication methods ensure that transactions conducted through Easypay are safeguarded against unauthorized access and fraudulent activities. Users can have peace of mind knowing that their sensitive information is kept confidential and secure at all times.

In addition to its core payment functionality, Easypay offers a variety of supplementary features and services to enhance the user experience. These may include tools for budgeting and financial management, rewards programs that incentivize usage, and exclusive offers or promotions available only to Easypay users. These value-added services complement the primary payment capabilities of Easypay, providing users with additional benefits and incentives for utilizing the platform.

Read Also: How to Purchase an Item from a Disney Store

Benefits of Using Easypay Finance for Easy Payments

One of the key benefits of Easypay Finance is its convenience. With Easypay, users can say goodbye to the hassle of carrying cash or digging through their wallets for cards. Instead, they can simply use their Easypay account to make payments quickly and easily, whether they are shopping online or paying bills.

This convenience saves time and eliminates the need to remember multiple passwords or account numbers, streamlining the payment process for users. Another advantage of Easypay Finance is its widespread acceptance. Easypay has partnered with a vast network of merchants and service providers, ensuring that users can use the platform to make payments at a wide range of establishments.

Whether it is grocery stores, restaurants, or online retailers, Easypay is accepted almost everywhere, providing users with unparalleled flexibility and convenience when it comes to managing their finances. Security is a top priority for Easypay Finance, and the platform employs state-of-the-art security measures to protect users’ sensitive information.

From advanced encryption technology to multi-factor authentication, Easypay ensures that transactions conducted through the platform are safe and secure. Users can have peace of mind knowing that their financial data is protected from unauthorized access and fraudulent activities, allowing them to use Easypay with confidence.

In addition to its core payment functionality, Easypay Finance offers a range of additional features and services designed to enhance the user experience. For example, users can use Easypay to track their spending, set budgeting goals, and even earn rewards for using the platform. These value-added services provide users with additional incentives for utilizing Easypay and help them manage their finances more effectively.

Easypay Finance is also user-friendly, with an intuitive interface that makes it easy for users to navigate the platform and complete transactions. Whether they’re new to digital payments or seasoned veterans, users can quickly familiarize themselves with Easypay and start using it to make payments with ease. The platform also offers customer support to assist users with any questions or issues they may encounter, ensuring a smooth and hassle-free experience.

Another benefit of Easypay Finance is its affordability. Unlike traditional payment methods that may incur fees or charges, Easypay is often free to use for basic transactions. This means that users can make payments without worrying about additional costs, allowing them to keep more of their hard-earned money in their pockets.

How to Get Started with Easypay Finance

Getting started with Easypay Finance is designed to be straightforward and user-friendly, ensuring a smooth experience even for those who are new to digital payment platforms. Here is a step-by-step guide to help you set up your account and start using Easypay Finance.

1. Visit the Easypay Finance Website or Download the Mobile App: The first step is to access the Easypay Finance platform. You can do this by visiting their official website on your computer or by downloading the Easypay mobile app from your device’s app store.

The app is available for both iOS and Android devices, making it widely accessible to users with different types of smartphones and tablets. Whether you choose to use the website or the mobile app, the process of getting started remains similar.

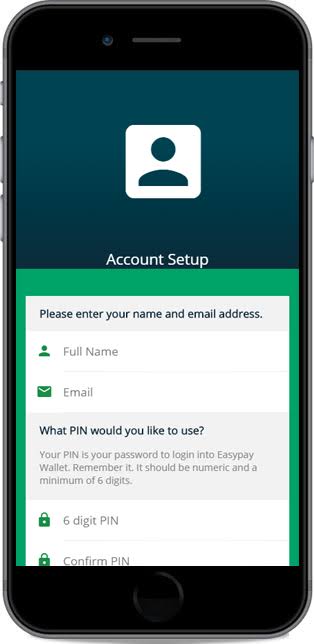

2. Sign Up or Get Started: Once you have accessed the website or downloaded the app, look for the “Sign Up” or “Get Started” button. Clicking this will initiate the registration process. This step is crucial as it begins the setup of your Easypay account. The platform is designed to guide you through each stage with clear instructions, making it easy to follow even if you are not particularly tech-savvy.

3. Enter Personal Information: During the registration process, you will be asked to provide some basic personal information. This typically includes your full name, email address, and phone number. You will also need to create a secure password for your account.

Additionally, Easypay may require you to provide further details such as your date of birth and residential address. This information is necessary to verify your identity and ensure the security of your account. It is important to provide accurate and up-to-date information to avoid any issues with account verification.

4. Verify Your Email or Phone Number: After entering your personal information, Easypay Finance will send a verification code to your email address or phone number. This step is essential to confirm that the contact information you provided is correct and to secure your account.

Check your email inbox or SMS messages for the verification code, then enter it on the Easypay platform to complete this step. Verification helps prevent unauthorized access to your account and ensures that you are the rightful owner of the contact information provided.

5. Set Up Payment Methods: With your account verified, the next step is to set up your payment methods. Easypay Finance supports a variety of payment options to accommodate different user preferences. You can link your bank account by providing your bank account number and routing number.

Additionally, you can add credit or debit cards by entering the card number, expiration date, and CVV code. The platform uses advanced encryption technology to protect your financial information during this process, ensuring that your data remains secure.

6. Add Funds to Your Easypay Account: Once your payment methods are set up, you can add funds to your Easypay account. This can be done by transferring money from your linked bank account or card. Typically, the transfer process is quick, with funds appearing in your Easypay account almost instantly. Having funds in your Easypay account enables you to make payments and complete transactions with ease.

7. Explore the Dashboard: After funding your account, take some time to familiarize yourself with the Easypay dashboard. The dashboard is the central hub where you can view your available balance, recent transactions, and other account details. Easypay’s user-friendly interface makes it easy to navigate and find the information you need. Exploring the dashboard will help you understand how to manage your account effectively.

8. Make Payments: One of the main features of Easypay Finance is the ability to make payments quickly and easily. To make a payment, select the “Pay” option from the dashboard. You can choose the recipient from your contact list or manually enter their details.

Specify the amount you wish to send and confirm the transaction. Easypay will process the payment and notify you once it is complete. This feature is ideal for paying friends, family, or businesses without the need for cash or physical cards.

9. Pay Bills: Easypay Finance also allows you to pay bills directly from your account. Navigate to the “Bill Pay” section, select the biller from the list, enter the amount due, and confirm the payment. Many utility companies, phone service providers, and other businesses accept Easypay as a payment method, making it a convenient way to manage your monthly expenses. This feature ensures that you never miss a payment and helps you stay organized.

10. Request Money: Another useful feature of Easypay Finance is the ability to request money from others. If someone owes you money or if you need to collect payments from a group, you can use the “Request Money” feature.

Enter the amount you need to request and select the contacts to send the request to. The recipients will receive a notification and can easily send the requested amount to your Easypay account. This feature simplifies the process of collecting money and ensures that you receive payments promptly.

11. Use Budgeting Tools: Easypay Finance offers tools to help you manage your finances more effectively. These budgeting tools allow you to track your spending, set financial goals, and gain insights into your spending habits.

By categorizing your expenses and monitoring your transactions, you can make informed decisions about your finances and work towards achieving your savings goals. These tools are especially helpful for users who want to maintain financial discipline and improve their budgeting skills.

12. Earn Rewards and Promotions: Easypay Finance often provides rewards and promotions to incentivize users. By using the platform for your transactions, you can earn cashback, discounts, and other rewards. Check the “Rewards” or “Promotions” section within the app or website to stay updated on the latest offers. Participating in these programs can add extra value to your experience with Easypay Finance, making it even more beneficial to use the platform for your payments.

13. Access Customer Support: Customer support is an essential aspect of any financial service, and Easypay Finance excels in this area. If you encounter any issues or have questions about your account, payments, or any other aspect of the platform, you can reach out to their customer support team.

Easypay offers multiple channels for support, including email, phone, and live chat. Access the “Help” or “Support” section in the app or on the website to find the best way to contact them. Reliable customer support ensures that any problems you encounter can be resolved quickly and efficiently, giving you peace of mind while using Easypay Finance.

14. Explore Integration Capabilities: As you become more familiar with Easypay Finance, you might want to explore its integration capabilities. Many users find it useful to link their Easypay account with other financial tools and services they use.

This integration can streamline your financial management by consolidating various aspects of your finances into one platform. Easypay’s ability to integrate with other tools enhances its functionality and provides a more comprehensive solution for managing your money.

Read Also: How to Get Affordable Car Ownership With CarMax Finance

Steps on How to Make Payments with Easypay

Step 1: Log In to Your Easypay Account

To get started, open the Easypay mobile app on your smartphone or visit the Easypay website on your computer. Enter your login credentials, which include your email address or phone number and your secure password. If you have enabled multi-factor authentication, you may need to enter an additional code sent to your email or phone to verify your identity. This step ensures that your account is secure and only accessible to you.

Step 2: Navigate to the Payments Section

Once you are logged in, navigate to the payments section of the app or website. This is usually prominently displayed on the main dashboard or in the main menu. The payments section is your gateway to making various types of transactions, whether you are paying a friend, settling a bill, or making a purchase.

Step 3: Choose the Type of Payment

Easypay offers several payment options to suit different needs. Here are some common types of payments you can choose from:

- Person-to-Person Payments: For sending money to friends or family.

- Bill Payments: For paying utility bills, phone bills, and other regular expenses.

- Merchant Payments: For making purchases at stores or online.

- Requesting Money: For requesting payments from others.

Select the type of payment you wish to make. The interface will guide you through the specific steps for each payment type, ensuring you provide all the necessary information.

Step 4: Enter the Recipient’s Information

For person-to-person payments, you will need to enter the recipient’s information. This can be done in several ways:

- Select from Contacts: If the recipient is saved in your contact list, you can simply select their name. Easypay may sync with your phone’s contacts to make this easier.

- Enter Manually: If the recipient is not in your contacts, manually enter their email address or phone number associated with their Easypay account.

Make sure the recipient’s information is accurate to avoid any delays or issues with the payment.

Step 5: Specify the Payment Amount

Next, enter the amount you wish to send. The interface will provide a field where you can type in the amount. Take care to enter the correct amount, as this will determine the total payment made to the recipient. If you are paying a bill, make sure to enter the exact amount due to avoid underpayment or overpayment.

Step 6: Add a Note or Description

Many payment platforms, including Easypay, allow you to add a note or description to your payment. This can be particularly useful for keeping track of your transactions. For instance, you can specify that a payment is for rent, groceries, or a gift. Adding a note helps both you and the recipient remember the purpose of the payment.

Step 7: Review and Confirm the Payment

Before finalizing the payment, review all the details carefully. Check the recipient’s information, the payment amount, and any notes or descriptions you have added. Ensuring that all information is correct helps prevent mistakes and ensures that your payment is processed smoothly.

Step 8: Select a Payment Method

Choose the payment method you want to use for this transaction. Easypay typically allows you to select from your linked bank accounts, credit or debit cards, or your Easypay balance. If you have multiple payment methods linked, you can choose the most appropriate one for the specific transaction.

Step 9: Confirm the Payment

Once you have reviewed all the details and selected your payment method, it’s time to confirm the payment. Click or tap on the “Confirm” or “Send” button to initiate the transaction. Easypay will process the payment and notify you once it is complete. You might receive a confirmation message or email, which serves as a receipt for your records.

Step 10: Check Transaction History

After making a payment, it’s a good idea to check your transaction history. Navigate to the transaction history section of the Easypay app or website to ensure the payment was processed correctly. Here, you can view details of all your recent transactions, including the amounts, recipients, and dates. Keeping track of your transactions helps you manage your finances more effectively and provides a clear record of all payments made.

Step 11: Setting Up Recurring Payments

If you have regular payments to make, such as monthly bills or subscriptions, consider setting up recurring payments through Easypay. This feature allows you to automate your payments, ensuring they are made on time every month without the need for manual intervention.

To set up a recurring payment, navigate to the recurring payments section, select the recipient or biller, enter the amount, and choose the frequency (e.g., monthly, weekly). Confirm the setup, and Easypay will handle the rest, deducting the specified amount from your account at the chosen intervals.

Step 12: Utilize Bill Splitting

Easypay also offers a convenient bill-splitting feature, perfect for situations where you need to share expenses with others, such as dining out with friends or sharing household bills. To use this feature, select the “Bill Splitting” option, enter the total amount, and add the participants by selecting them from your contacts or entering their details manually. Easypay will calculate each person’s share and send a payment request to them. This feature simplifies the process of managing shared expenses and ensures that everyone pays their fair share.

Step 13: Keep Your Account Secure

Maintaining the security of your Easypay account is crucial. Always log out of your account when using public or shared devices. Enable multi-factor authentication if you haven’t already, and regularly update your password to something strong and unique. Be cautious of phishing attempts and never share your login credentials with anyone. Keeping your account secure ensures that your financial information remains protected.

Step 14: Contact Customer Support for Issues

If you encounter any issues while making payments or have questions about your transactions, do not hesitate to contact Easypay’s customer support. They offer various support channels, including email, phone, and live chat. Access the “Help” or “Support” section in the app or on the website to find the best way to reach out. Customer support can assist with resolving any problems and guide on using the platform’s features effectively.

Step 15: Stay Updated with Easypay Features

Easypay continuously updates its platform with new features and enhancements. Stay informed about these updates by checking the Easypay blog, following them on social media, or subscribing to their newsletter. New features can improve your payment experience and provide additional tools for managing your finances more efficiently.

Tips and Tricks for Maximizing the Ease of Easypay Finance

Easypay Finance offers numerous features designed to simplify your financial transactions and enhance your overall payment experience. To get the most out of Easypay Finance, here are some tips and tricks that can help you maximize its ease and efficiency.

1. Keep Your Profile Updated: Regularly updating your personal and financial information on Easypay Finance ensures smooth transactions and improved security. Make sure your contact details, such as email address and phone number, are current. This will help you receive timely notifications and verification codes. Additionally, keeping your payment methods up-to-date, including bank account and card details, will prevent transaction failures and ensure seamless payments.

2. Use Multi-Factor Authentication: Enable multi-factor authentication (MFA) on your Easypay Finance account. MFA adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone or email, in addition to your password. This significantly reduces the risk of unauthorized access to your account and protects your financial information.

3. Take Advantage of Recurring Payments: Set up recurring payments for regular bills and subscriptions. Easypay Finance allows you to automate these payments, ensuring they are made on time each month. This not only saves you time but also helps avoid late fees and missed payments. To set up a recurring payment, navigate to the recurring payments section, select the biller or recipient, enter the payment amount, and choose the frequency. Confirm the setup, and Easypay will handle the rest.

4. Monitor Your Transaction History: Regularly review your transaction history to keep track of your spending and ensure all transactions are accurate. Easypay Finance provides a detailed transaction history section where you can view all your recent payments, including amounts, recipients, and dates. This helps you manage your finances better and quickly spot any unauthorized or suspicious activity.

5. Utilize Budgeting Tools: Easypay Finance offers budgeting tools that can help you manage your finances more effectively. These tools allow you to categorize your expenses, set financial goals, and monitor your spending habits. By using these features, you can gain insights into your financial behavior and make informed decisions about your spending and saving practices.

6. Split Bills Easily: When sharing expenses with friends or family, use Easypay’s bill-splitting feature. This tool simplifies the process of dividing costs, such as restaurant bills or household expenses. To use this feature, select the “Bill Splitting” option, enter the total amount, and add the participants by selecting them from your contacts or entering their details manually. Easypay will calculate each person’s share and send a payment request to them, making it easy for everyone to pay their portion.

7. Keep an Eye on Promotions and Rewards: Easypay Finance often runs promotions and reward programs that offer cashback, discounts, and other incentives. Regularly check the “Rewards” or “Promotions” section within the app or website to stay updated on the latest offers. Participating in these programs can provide additional value and savings, making your Easypay experience even more beneficial.

8. Use Easypay for Merchant Payments: Many businesses accept Easypay as a payment method. Whether shopping online or in-store, look for the Easypay payment option at checkout. Using Easypay for merchant payments can streamline the purchasing process and often comes with additional security features that protect your transactions.

9. Request Money with Ease: Easypay Finance allows you to request money from others easily. If someone owes you money or you need to collect payments from a group, use the “Request Money” feature. Enter the amount you need to request and select the contacts to send the request to. The recipients will receive a notification and can quickly send the requested amount to your Easypay account. This feature simplifies the process of collecting money and ensures timely payments.

10. Link Multiple Payment Methods: To enhance flexibility, link multiple payment methods to your Easypay account. You can add various bank accounts, credit, and debit cards. This allows you to choose the most suitable payment method for different transactions, ensuring you always have a backup option if one method is temporarily unavailable.

11. Stay Informed with Notifications: Enable notifications on your Easypay app to stay informed about your account activity. Notifications can alert you to successful payments, incoming funds, promotional offers, and security alerts. Keeping these notifications enabled helps you stay on top of your finances and quickly respond to any important updates or issues.

12. Explore Integration with Other Financial Tools: Easypay Finance can integrate with other financial tools and services you use, such as budgeting apps and accounting software. These integrations can streamline your financial management by consolidating various aspects of your finances into one platform. Explore the integration options available within Easypay to enhance your financial management capabilities.

13. Secure Your Account: Maintaining the security of your Easypay account is crucial. Use a strong and unique password, and change it regularly. Be cautious of phishing attempts and never share your login credentials with anyone. Always log out of your account when using public or shared devices. These practices help protect your account from unauthorized access and ensure your financial information remains secure.

14. Access Customer Support: If you encounter any issues or have questions about using Easypay Finance, reach out to their customer support. Easypay offers various support channels, including email, phone, and live chat. Access the “Help” or “Support” section in the app or on the website to find the best way to contact them. Reliable customer support can assist with resolving problems and provide guidance on using the platform’s features effectively.

15. Stay Updated with Easypay News: Easypay continuously updates its platform with new features and enhancements. Stay informed about these updates by checking the Easypay blog, following them on social media, or subscribing to their newsletter. New features can improve your payment experience and provide additional tools for managing your finances more efficiently.

16. Set Financial Goals: Use Easypay’s tools to set financial goals. Whether you are saving for a major purchase, paying off debt, or building an emergency fund, setting clear financial goals can help you stay focused and motivated. Easypay’s budgeting and tracking features can assist you in monitoring your progress towards these goals.

17. Leverage Referral Programs: Easypay Finance may offer referral programs where you can earn rewards by inviting friends and family to join the platform. Take advantage of these programs by sharing your referral code with others. Not only can you earn bonuses, but you also help others discover the benefits of using Easypay.

18. Regularly Review Your Spending: Periodically review your spending patterns using Easypay’s insights and reports. Understanding where your money goes each month can help you identify areas where you can cut costs and save more. Regular reviews enable you to make adjustments to your budget and spending habits, leading to better financial health.

19. Manage Notifications Preferences: Customize your notification preferences to suit your needs. You can choose to receive alerts for specific activities, such as large transactions, low balance warnings, or promotional offers. Tailoring your notifications ensures you only receive the most relevant updates, keeping you informed without being overwhelmed.

20. Educate Yourself About Financial Management: Take advantage of Easypay’s educational resources. Many digital finance platforms offer blogs, webinars, and tutorials to help users improve their financial literacy. Learning more about financial management can empower you to make smarter decisions and maximize the benefits of using Easypay Finance.

In conclusion, by following these tips and tricks, you can maximize the ease and efficiency of Easypay Finance. This platform offers a comprehensive set of tools and features designed to simplify your financial transactions, enhance security, and provide valuable insights into your spending habits. Utilizing these features effectively helps you manage your finances better and enjoy a seamless payment experience in today’s digital world.