Google Finance provides users with a comprehensive platform for tracking financial markets, analyzing stocks, and accessing real-time market data. But what exactly is Google Finance, and how can individuals leverage its features to enhance their financial acumen and investment strategies? At its core, Google Finance is a free web-based service that offers a wide range of financial information and tools to help users navigate the complex world of investing.

Launched in 2006, Google Finance was designed to provide users with easy access to real-time stock quotes, news, and financial data from various global exchanges. Over the years, the platform has evolved to offer an array of features tailored to the needs of both casual investors and seasoned professionals.

One of the standout features of Google Finance is its intuitive and user-friendly interface, which allows users to quickly access the information they need without having to navigate through complex menus or interfaces. Finance Google provides users with the ability to track their investments and stay informed about market trends.

Upon visiting the Google Finance website or accessing it through the Google search engine, users are greeted with a clean and organized layout that prominently displays key market indices, top movers, and trending stocks.

Furthermore, Google Finance offers users the ability to create personalized portfolios, where they can track the performance of their investments in real-time. By simply entering the ticker symbols of their holdings, users can easily monitor the value of their portfolio, view detailed stock charts, and analyze historical performance data.

This feature is particularly useful for investors looking to stay on top of their investment portfolios and make informed decisions based on market trends and performance metrics. In addition to portfolio tracking, Google Finance provides users with access to a wealth of financial news and analysis from trusted sources such as Reuters, Bloomberg, and CNBC.

Whether it is breaking news on corporate earnings, economic indicators, or market trends, users can stay informed and up-to-date with the latest developments impacting the financial markets. Another key feature of Google Finance is its robust stock screener tool, which allows users to filter and screen stocks based on various criteria such as market capitalization, dividend yield, and price-to-earnings ratio.

This powerful tool enables users to identify potential investment opportunities and narrow down their search to stocks that meet their specific investment criteria. Moreover, Google Finance offers users the ability to access detailed company profiles and financial statements for individual stocks.

By simply entering the name or ticker symbol of a company, users can view key financial metrics, analyst ratings, insider trading activity, and more. This comprehensive information empowers users to conduct thorough due diligence and make informed investment decisions based on a company’s fundamentals and performance.

Furthermore, Google Finance provides users with access to interactive stock charts that allow for in-depth technical analysis and charting. Whether it is plotting moving averages, drawing trend lines, or analyzing price patterns, users can utilize these tools to identify potential entry and exit points for their trades.

How to Access Google Finance

Accessing Google Finance is a straightforward process that provides users with a wealth of financial information, market data, and investment tools. The various ways to access Google Finance and make the most of its features are as follows:

1. Using the Google Finance Website: The most direct way to access Google Finance is through its dedicated website. Simply open your web browser and navigate to finance.google.com. Once on the website, you will be greeted with a clean and organized interface that provides easy access to a wide range of financial information and tools.

2. Google Search: Another convenient way to access Google Finance is through the Google search engine. Simply enter the name of a stock, index, or financial term followed by “Google Finance” into the search bar. For example, typing “AAPL Google Finance” will bring up the Google Finance page for Apple Inc., where you can find detailed information about the company’s stock performance, financials, and news.

3. Google Finance App: For users who prefer accessing financial information on their mobile devices, Google offers the Google Finance app for both Android and iOS devices. Simply download the app from the Google Play Store or Apple App Store, and log in with your Google account to access real-time market data, news, and personalized portfolio tracking on the go.

4. Google Search Bar: If you are using the Google search engine, you can also access basic financial information directly from the search bar. Simply type the name of a stock followed by “stock price” or “stock quote” into the search bar, and Google will display real-time stock quotes along with additional information such as market cap, P/E ratio, and more.

5. Google Sheets Integration: For users who prefer to analyze financial data in spreadsheets, Google Finance offers seamless integration with Google Sheets. Simply open Google Sheets and use the “GOOGLE FINANCE” function to pull real-time financial data directly into your spreadsheet. This feature allows users to create custom financial models, track stock performance, and conduct in-depth analysis using the powerful tools available in Google Sheets.

6. Google Assistant: Google Assistant, the virtual assistant developed by Google, can also provide access to financial information and market data. Simply ask Google Assistant questions like “What is the stock price of Apple?” or “What is the current price-to-earnings ratio of Amazon?” and it will provide you with the information you need using data sourced from Google Finance.

7. Google Search Widgets: On Android devices, users can add Google Finance widgets to their home screens for quick access to real-time stock quotes and market data. Simply long-press on your device’s home screen, select “Widgets,” and choose the Google Finance widget that best suits your needs. You can customize the widget to display information for specific stocks or indices, allowing you to stay informed at a glance.

8. Google Chrome Extensions: For users who frequently use the Google Chrome web browser, there are several Chrome extensions available that provide access to Google Finance directly from the browser toolbar. Simply install the extension from the Chrome Web Store, and you’ll have instant access to real-time market data, stock quotes, and news updates without having to navigate away from your browsing session.

Read Also: The Ultimate Guide to Using a Finance Calculator

Creating a Portfolio on Google Finance

Creating a portfolio on Google Finance is a straightforward process that allows users to track the performance of their investments, monitor market trends, and stay informed about the latest financial news. Whether you are a seasoned investor managing a diverse portfolio or a novice looking to get started, Google Finance offers a user-friendly platform to organize and analyze your investments.

1. Sign in to Google Account: To get started, you will need to sign in to your Google account. If you do not have one, you can easily create a new account for free. Signing in will enable you to access Google Finance and save your portfolio settings across devices.

2. Navigate to Google Finance: Once you are signed in, navigate to the Google Finance website or open the Google Finance app on your mobile device. You can also access Google Finance through the Google search engine by searching for “Google Finance” or the name of a specific stock followed by “Google Finance.”

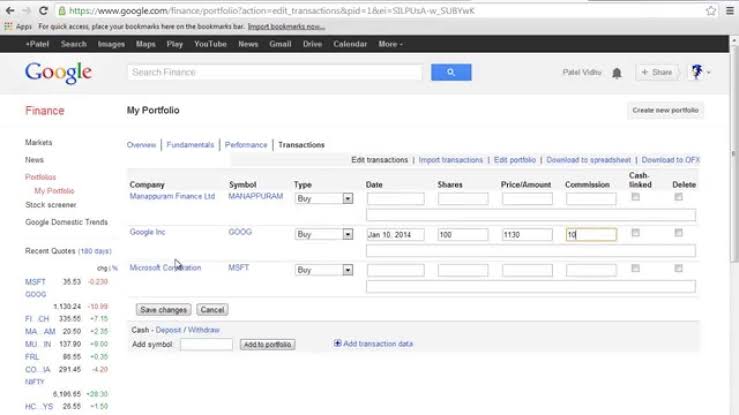

3. Click on “Portfolios”: On the Google Finance homepage, you will find a navigation menu at the top of the screen. Click on the “Portfolios” tab to access the portfolio management tools.

4. Create a New Portfolio: If you are creating a portfolio for the first time, you will need to click on the “Create new portfolio” button. Give your portfolio a name that reflects its purpose or the types of investments it will contain. For example, you could name it “Tech Stocks” or “Retirement Portfolio.”

5. Add Holdings: Once you have created your portfolio, you can start adding holdings by entering the ticker symbols of the stocks, mutual funds, ETFs, or other securities you want to track. You can add holdings manually by typing in the ticker symbols, or you can import holdings from a CSV file if you have a list prepared.

6. Customize Holdings: After adding holdings to your portfolio, you can customize them by specifying the number of shares or units you own, as well as the purchase price and date. This information will allow Google Finance to calculate the current value of your holdings, as well as your overall portfolio performance.

7. Track Performance: Once your portfolio is set up, you can track its performance in real-time. Google Finance provides users with a range of performance metrics and charts to help visualize portfolio performance over time. You can view changes in the value of your holdings, as well as overall portfolio gains or losses.

8 .Analyze Holdings: In addition to tracking performance, Google Finance allows users to analyze individual holdings within their portfolio. You can view detailed information about each holding, including key financial metrics, analyst ratings, news articles, and more. This information can help you make informed decisions about buying, selling, or holding onto your investments.

9. Set Alerts: Google Finance also allows users to set up price alerts for individual holdings within their portfolio. You can specify price thresholds at which you want to be notified, and Google Finance will send you email alerts when those thresholds are reached. This feature is useful for staying informed about significant price movements and taking action accordingly.

10. Access News and Insights: Google Finance provides users with access to a wealth of financial news and insights from trusted sources such as Reuters, Bloomberg, and CNBC. You can stay informed about the latest developments in the financial markets, as well as specific news related to the companies in your portfolio.

11. Share Portfolio: If you are working collaboratively with others or seeking advice from a financial advisor, Google Finance allows you to share your portfolio with others. You can generate a shareable link to your portfolio or invite specific individuals to view or edit the portfolio directly.

12. Review and Rebalance: Regularly review and rebalance your portfolio to ensure it remains aligned with your investment goals and risk tolerance. Rebalancing involves buying or selling assets within your portfolio to maintain your desired asset allocation and minimize risk.

Utilizing the News and Market Data on Google Finance

Utilizing the news and market data on Google Finance can provide investors with valuable insights, help them stay informed about the latest developments, and make informed investment decisions. Exploring how investors can effectively utilize the news and market data on Google Finance to enhance their investment strategies.

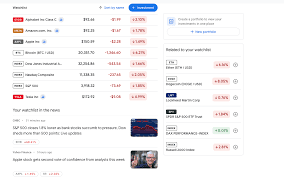

1. Accessing Market Data: One of the primary features of Google Finance is its ability to provide users with access to real-time market data. Users can easily track stock prices, indices, currencies, commodities, and other financial instruments from various global exchanges.

By simply entering the ticker symbol or name of a security into the search bar, users can quickly access key information such as current price, trading volume, market capitalization, and more. This real-time data enables investors to stay informed about market movements and make timely investment decisions.

2. Monitoring Stock Performance: Google Finance allows users to monitor the performance of individual stocks within their portfolio or watchlist. Users can view detailed stock charts, which provide information such as price movements, trading volume, and technical indicators.

By analyzing these charts, investors can identify trends, patterns, and potential trading opportunities. Google Finance also offers interactive stock charts with customizable timeframes, allowing users to zoom in on specific periods and analyze historical price data.

3. Tracking Market Indices: In addition to individual stocks, Google Finance provides users with access to a wide range of market indices from around the world. Users can track major indices such as the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite, as well as regional indices from Europe, Asia, and other regions. Monitoring market indices can help investors gauge overall market sentiment, identify market trends, and assess the performance of their investment portfolios relative to the broader market.

4. Analyzing Financial News: Google Finance aggregates financial news articles from a variety of trusted sources, including Reuters, Bloomberg, CNBC, and more. Users can access the latest news headlines directly from the Google Finance homepage or search for specific news articles related to individual stocks or companies. By staying informed about the latest developments in the financial markets, investors can better understand market dynamics, anticipate potential risks, and identify investment opportunities.

5. Customizing News Feed: Google Finance allows users to customize their news feed based on their interests and preferences. Users can follow specific stocks, sectors, or industries to receive relevant news updates and analysis. By tailoring their news feed to focus on areas of interest, investors can filter out noise and stay focused on the information that matters most to their investment strategies.

6. Setting News Alerts: To stay ahead of market-moving news events, Google Finance offers users the ability to set up news alerts for specific stocks or keywords. Users can specify criteria for their alerts, such as price movements, volume spikes, or specific news topics.

When a relevant news article is published, Google Finance will send users email alerts to notify them of the news event. This feature enables investors to react quickly to breaking news and adjust their investment strategies accordingly.

7. Accessing Company Profiles: Google Finance provides users with access to detailed company profiles for individual stocks. These profiles include key information such as company overview, financial metrics, analyst ratings, insider trading activity, and more. By analyzing company profiles, investors can gain insights into a company’s fundamentals, growth prospects, and competitive positioning within its industry.

8. Utilizing Market Screener: Google Finance offers a market screener tool that allows users to filter and screen stocks based on various criteria such as market capitalization, dividend yield, price-to-earnings ratio, and more. Investors can use this tool to identify potential investment opportunities, screen for undervalued or overvalued stocks, and narrow down their search to stocks that meet their specific investment criteria.

9. Analyzing Historical Data: Google Finance provides users with access to historical market data, allowing them to analyze price movements, trends, and patterns over time. Users can view historical stock charts, perform technical analysis, and identify recurring patterns that may inform their investment decisions. By studying historical data, investors can gain insights into market behavior and make more informed predictions about future price movements.

10. Utilizing Insights and Trends: Google Finance offers insights and trends features that highlight notable market events, emerging trends, and popular stocks among users. By monitoring these insights, investors can identify emerging investment themes, capitalize on market trends, and stay ahead of the curve.

Additionally, Google Finance provides users with access to curated lists of top gainers, top losers, and most active stocks, allowing them to quickly identify stocks that are experiencing significant price movements.

Read Also: Guide on How to Start a Coffee Shop

Tips and Tricks for Mastering Google Finance

Mastering Google Finance requires familiarity with its features and understanding how to leverage them effectively to analyze investments, track market trends, and make informed decisions. Whether you are a novice investor or a seasoned professional, here are some tips and tricks to help you get the most out of Google Finance:

1. Customize Your Dashboard: Take advantage of Google Finance’s customizable dashboard to tailor the information displayed to your specific needs. You can rearrange widgets, add or remove sections, and prioritize the data that matters most to you. By customizing your dashboard, you can create a personalized view that enhances your workflow and helps you stay focused on key metrics and insights.

2. Utilize Keyboard Shortcuts: Google Finance offers a range of keyboard shortcuts to streamline navigation and improve efficiency. For example, you can use the arrow keys to navigate between different sections of the website, press “F” to add a stock to your watchlist, or use the “/” key to focus the cursor on the search bar. Familiarizing yourself with these shortcuts can save time and make your user experience more seamless.

3. Explore Advanced Charting Tools: Google Finance offers a variety of advanced charting tools that allow you to perform in-depth technical analysis and visualize market trends. Experiment with features such as moving averages, Bollinger Bands, and MACD indicators to identify patterns and signals that may inform your trading decisions. You can also customize chart settings to display different timeframes, overlays, and indicators based on your preferences.

4. Set Up Price Alerts: Stay informed about significant price movements by setting up price alerts for individual stocks or indices. Google Finance allows you to specify price thresholds at which you want to be notified, and you can choose to receive alerts via email or push notification. Price alerts can help you stay ahead of market trends and take timely action to capitalize on trading opportunities or mitigate risk.

5. Analyze Historical Data: Dive into historical market data to gain insights into past price movements, trends, and patterns. Google Finance provides access to historical stock charts, allowing you to analyze price performance over different timeframes. By studying historical data, you can identify recurring patterns, evaluate the effectiveness of past trading strategies, and make more informed predictions about future price movements.

6. Track Market News and Events: Stay informed about the latest market news and events by regularly checking Google Finance’s news section. You can access curated news articles from trusted sources such as Reuters, Bloomberg, and CNBC, as well as company-specific news related to stocks in your portfolio or watchlist. Keeping abreast of market developments can help you anticipate potential market-moving events and adjust your investment strategy accordingly.

7. Use the Market Screener Tool: Google Finance offers a powerful market screener tool that allows you to filter and screen stocks based on various criteria such as market capitalization, dividend yield, price-to-earnings ratio, and more. Take advantage of this tool to identify potential investment opportunities, screen for undervalued or overvalued stocks, and narrow down your search to stocks that meet your specific investment criteria.

8. Leverage Insights and Trends: Explore Google Finance’s insights and trends features to identify emerging investment themes, popular stocks among users, and notable market trends. By monitoring these insights, you can stay ahead of the curve, capitalize on market trends, and make informed investment decisions. Additionally, you can access curated lists of top gainers, top losers, and most active stocks to quickly identify stocks experiencing significant price movements.

9. Stay Organized with Watchlists and Portfolios: Organize your investments and track their performance using Google Finance’s watchlists and portfolios. Create separate watchlists for different sectors, industries, or investment strategies, and use portfolios to track the performance of your investment holdings over time. By staying organized, you can monitor your investments more effectively and make informed decisions based on real-time data and insights.

9. Explore Additional Resources and Tools: In addition to its core features, Google Finance offers a range of additional resources and tools to help investors master the market. Explore features such as market news, company profiles, insider trading activity, and analyst ratings to gain deeper insights into individual stocks and market dynamics. Additionally, consider integrating Google Finance with other Google products such as Google Sheets and Google Assistant to streamline your workflow and enhance your analytical capabilities.

In conclusion, mastering Google Finance requires familiarity with its features and understanding how to leverage them effectively to analyze investments, track market trends, and make informed decisions. By customizing your dashboard, setting up price alerts, tracking market news and events, staying organized with watchlists and portfolios, exploring additional resources and tools and so on, you can enhance your investment strategy and achieve your financial goals.

Read Also: Education, Entertainment Vital for Pupils