Toyota Finance, an integral part of Toyota Motor Corporation, offers a range of financial services to support customers in purchasing or leasing Toyota vehicles. Toyota Finance provides financing options, leasing programs, and insurance products tailored to meet the diverse needs of customers.

With a commitment to transparency, flexibility, and customer satisfaction, Toyota Finance aims to make vehicle ownership accessible and affordable for everyone. Toyota Finance offers a variety of financing options to help customers purchase a Toyota vehicle. Whether you’re interested in buying a new or used car, Toyota Finance can provide flexible financing solutions to fit your budget and lifestyle.

With competitive interest rates, customizable loan terms, and convenient payment options, Toyota Finance makes it easy for customers to finance their dream car. Leasing is another popular option offered by Toyota Finance, allowing customers to drive a new Toyota vehicle for a set period of time without the commitment of ownership.

With leasing, customers can enjoy lower monthly payments, flexible lease terms, and the option to upgrade to a new vehicle at the end of the lease term. Toyota Finance offers leasing programs designed to meet the needs of both individuals and businesses, making it a convenient and cost-effective option for drivers.

In addition to financing and leasing options, Toyota Finance offers a range of insurance products to protect customers and their vehicles. From comprehensive auto insurance to extended warranty coverage, Toyota Finance provides peace of mind and protection against unexpected expenses.

With affordable premiums, flexible coverage options, and dedicated customer support, Toyota Finance ensures that customers can drive with confidence knowing that they’re covered in the event of an accident or unforeseen circumstance.Toyota Finance is committed to providing exceptional customer service and support throughout the financing or leasing process.

Whether you’re applying for a loan, exploring leasing options, or purchasing insurance, Toyota Finance offers personalized assistance and guidance to help you make informed decisions about your vehicle purchase. With a team of knowledgeable and experienced professionals, Toyota Finance strives to make the financing process simple, straightforward, and hassle-free for customers.

Moreover, Toyota Finance prioritizes transparency and integrity in its operations, providing customers with clear and concise information about their financing options, terms, and conditions. With transparent pricing, no hidden fees, and easy-to-understand contracts, Toyota Finance ensures that customers have a complete understanding of their financial obligations and responsibilities.

Read Also: A Comprehensive Guide to Gross Income

The Benefits of Toyota Finance

Toyota Finance offers a plethora of advantages for consumers, facilitating a seamless and convenient experience for those seeking to finance or lease a Toyota vehicle. With competitive interest rates, transparent pricing, and dedicated support, Toyota Finance ensures that customers can drive away with confidence and peace of mind.

Firstly, Toyota Finance provides flexible financing options, catering to the diverse needs and preferences of consumers. Regardless of whether one is purchasing a new or used car, Toyota Finance offers a variety of financing solutions that can be tailored to fit individual budgets and lifestyles.

With customizable loan terms, competitive interest rates, and convenient payment options, Toyota Finance simplifies the process of finding the right financing package. Furthermore, Toyota Finance expedites approval processes, enabling customers to swiftly obtain approval and acquire their desired vehicle without unnecessary delays.

Leasing is another advantageous option presented by Toyota Finance. By opting for a lease, customers can benefit from lower monthly payments, flexible lease terms, and the opportunity to upgrade to a new vehicle at the conclusion of the lease term.

Toyota Finance’s leasing programs cater to both individuals and businesses, providing flexibility and convenience to those desiring to drive a new Toyota vehicle without committing to ownership. Additionally, Toyota Finance extends a range of insurance products to safeguard customers and their vehicles.

From comprehensive auto insurance to extended warranty coverage, Toyota Finance offers protection against unforeseen expenses and provides peace of mind to drivers. With affordable premiums, flexible coverage options, and dedicated customer support, Toyota Finance ensures that customers can traverse the roads with confidence, knowing they are covered in the event of an accident or unexpected circumstance.

Moreover, Toyota Finance delivers exceptional customer service and support throughout the financing or leasing process. Whether customers are applying for a loan, exploring leasing options, or procuring insurance, Toyota Finance offers personalized assistance and guidance to facilitate informed decision-making.

Backed by a team of knowledgeable and experienced professionals, Toyota Finance strives to streamline the financing process, ensuring it remains straightforward and hassle-free for consumers. Toyota Finance is committed to transparency and integrity in all its dealings, providing customers with clear and concise information regarding financing options, terms, and conditions.

With transparent pricing, devoid of hidden fees, and easily comprehensible contracts, Toyota Finance ensures that customers possess a comprehensive understanding of their financial obligations and responsibilities.

How Does Toyota Finance Work?

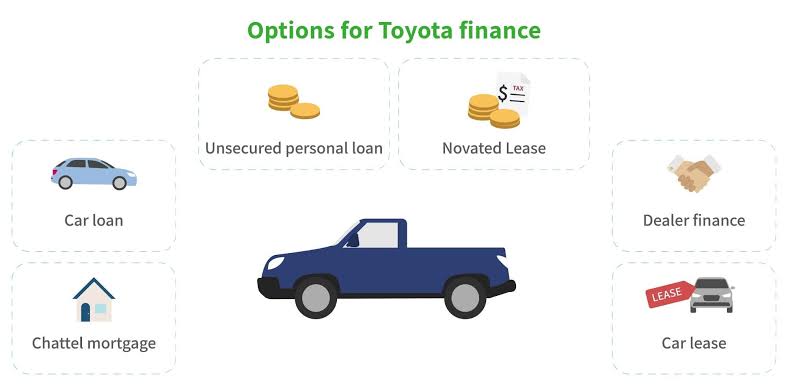

Toyota Finance provides customers with various financing options to facilitate the purchase or lease of Toyota vehicles. Understanding how Toyota Finance operates empowers individuals to make informed decisions when financing their next vehicle. Here’s an in-depth overview of Toyota Finance, covering its financing options, application process, repayment terms, managing accounts, special programs and incentives, and benefits.

Toyota Finance offers two primary financing options: leasing and financing. Leasing involves renting a vehicle for a specified period, typically two to three years. During the lease term, customers make monthly payments based on the vehicle’s depreciation value and usage. At the end of the lease term, they have the option to return the vehicle, purchase it at a predetermined price (known as the residual value), or lease a new Toyota vehicle.

On the other hand, financing, also known as purchasing or taking out a loan, involves borrowing money to purchase a Toyota vehicle outright. Customers repay the loan over a set term, typically three to seven years, with interest. Once the loan is fully repaid, they own the vehicle outright, and there are no further payments.

The application process for Toyota Finance is straightforward. Before applying, individuals should ensure they meet Toyota Finance’s eligibility criteria, which typically include age, income, and credit history requirements. Applications can be submitted online through the Toyota Finance website or in person at a Toyota dealership.

The application requires personal information such as name, address, contact details, employment information, and financial details. Once submitted, Toyota Finance reviews the application to assess creditworthiness and determine financing terms, including interest rates and repayment terms.

For both leasing and financing options, Toyota Finance offers flexible repayment terms to suit customers’ budgets. Lease payments are typically lower than loan payments because customers are only paying for the vehicle’s depreciation over the lease term. Loan payments consist of principal and interest and are spread out over the loan term.

Longer loan terms result in lower monthly payments but may lead to higher overall interest costs. Customers can choose the repayment option that best fits their budget and financial goals. After securing financing, customers need to manage their Toyota Finance accounts. This includes making payments, viewing account information, and updating contact information.

Payments can be made online through the Toyota Finance website, by phone, or by mail. Automatic payments are also available for added convenience. Customers can access account information, including payment history, statements, and account balances, online through the Toyota Finance website or mobile app.

It is essential to keep contact information up to date to ensure receipt of important account notifications and correspondence from Toyota Finance. Toyota Finance offers special programs and incentives to qualifying customers. These may include low APR financing promotions, cash rebates, incentives, or special lease offers on select models.

Special programs may also be available for recent college graduates, military personnel, and first-time buyers, making financing more accessible to these groups. By taking advantage of these programs and incentives, customers can save money and enjoy additional benefits when financing through Toyota Finance.

There are several benefits to financing through Toyota Finance. Competitive interest rates allow qualified customers to finance their vehicles at affordable rates. Flexible repayment terms and payment options make it easy for customers to manage their finances and stay on track with payments. Exclusive offers for Toyota customers provide added value and savings, making financing through Toyota Finance an attractive option.

Read Also: How to Choose the Right Service Finance

Step-by-Step Guide to Applying for Toyota Finance

Applying for Toyota finance is a straightforward process that enables consumers to secure financing for their vehicle purchase. Whether you’re interested in buying a new Toyota vehicle or a certified pre-owned model, Toyota finance offers flexible options to suit your budget and needs. This step-by-step guide will walk you through the process of applying for Toyota financing, ensuring a seamless and hassle-free experience.

Step 1: Research and Choose Your Vehicle

Before applying for Toyota finance, it is essential to research and select the vehicle you wish to purchase. Explore Toyota’s lineup of cars, trucks, SUVs, and hybrids to find the model that best fits your lifestyle and preferences. Consider factors such as size, features, fuel efficiency, and budget to narrow down your options and make an informed decision.

Step 2: Calculate Your Budget

Once you’ve chosen your desired vehicle, it’s time to calculate your budget and determine how much you can afford to spend. Take into account factors such as your monthly income, expenses, down payment amount, and desired loan term. Use Toyota’s online finance calculator or speak with a Toyota finance representative to estimate your monthly payments and ensure they fit within your budget.

Step 3: Gather Necessary Documents

Before applying for Toyota Finance, gather all necessary documents to expedite the application process. Typical documents may include proof of identity (such as a driver’s license or passport), proof of income (such as pay stubs or tax returns), proof of residence (such as a utility bill or lease agreement), and any additional documentation required by Toyota Finance.

Step 4: Visit a Toyota Dealership or Apply Online

Once you’ve completed your research, calculated your budget, and gathered your documents, it is time to apply for Toyota finance. You can either visit a Toyota dealership in person or apply online through Toyota’s website.

If visiting a dealership, speak with a finance representative who will guide you through the application process and answer any questions you may have. If applying online, simply fill out the online application form and submit your documents electronically.

Step 5: Complete the Application FormWhether applying in person or online, you will need to complete a Toyota finance application form. Provide accurate and up-to-date information, including personal details, employment information, financial information, and any co-applicant information if applicable. Double-check the information for accuracy before applying to avoid any delays in processing.

Step 6: Review and Accept Financing Terms

Once your application has been submitted, a Toyota finance representative will review your information and determine your eligibility for financing. If approved, you’ll receive a financing offer outlining the terms and conditions of the loan, including the interest rate, loan amount, loan term, and monthly payments. Review the offer carefully and ensure that you understand all terms and conditions before accepting the financing offer.

Step 7: Sign the Financing Agreement

If you are satisfied with the financing offer, it’s time to sign the financing agreement. This document outlines the terms and conditions of the loan and serves as a legally binding contract between you and Toyota Finance. Read the agreement carefully and ask any questions you may have before signing. Once signed, you’ll be one step closer to driving off in your new Toyota vehicle.

Step 8: Finalize Your Purchase

With the financing agreement signed, all that’s left to do is finalize your vehicle purchase. Work with the dealership to complete any remaining paperwork, arrange for payment of the down payment and any additional fees, and schedule a time to pick up your new Toyota vehicle. Congratulations – you are now the proud owner of a Toyota vehicle financed through Toyota Finance!

Tips for Using Toyota Finance

Using Toyota Finance effectively requires careful planning and consideration to ensure a smooth and successful financing experience. Here are some tips to help you make the most of Toyota Finance:

1. Assess Your Financial Situation: Before applying for Toyota Finance, take the time to assess your financial situation. Consider factors such as your income, expenses, savings, and existing debt obligations. Understanding your financial position will help you determine how much you can afford to borrow and what type of financing option is best suited to your needs.

2. Set a Realistic Budget: Based on your financial assessment, establish a realistic budget for your vehicle purchase or lease. Consider not only the monthly payment but also other costs such as insurance, maintenance, and fuel. Setting a budget will help you narrow down your options and avoid overspending.

3. Understand Your Financing Options: Familiarize yourself with the different financing options offered by Toyota Finance, including leasing and financing. Understand the pros and cons of each option, such as monthly payments, mileage restrictions, and ownership considerations. Choose the option that aligns with your budget and lifestyle.

4. Shop Around for Competitive Rates: Don’t settle for the first financing offer you receive. Shop around and compare rates from multiple lenders, including Toyota Finance and other financial institutions. Look for competitive interest rates, favorable loan terms, and any special promotions or incentives.

5. Negotiate the Terms of Your Financing: When finalizing your financing arrangement, don’t be afraid to negotiate the terms. Ask about any available discounts, incentives, or special financing offers. Negotiating the terms of your financing can help you secure a better deal and save money over the life of the loan or lease.

6. Read and Understand the Fine Print: Before signing any paperwork, carefully read and understand the terms and conditions of your financing agreement. Pay attention to details such as interest rates, fees, penalties, and any additional charges. Ask questions if anything is unclear, and make sure you fully understand your rights and obligations as a borrower.

7. Make a Down Payment if Possible: Consider making a down payment to reduce the amount you need to finance. A larger down payment can lower your monthly payments, reduce the total cost of financing, and potentially qualify you for better interest rates or terms. Save up for a down payment before applying for financing if possible.

8. Choose the Right Vehicle: Select a vehicle that fits your needs, preferences, and budget. Consider factors such as fuel efficiency, safety features, reliability, and resale value. Test drive different models to find the one that meets your requirements and provides the best value for your money.

9. Stay Within Your Means: Avoid financing a vehicle that stretches your budget too thin. Stick to your budget and resist the temptation to overspend on a more expensive car or additional features. Remember that your financial circumstances may change, so it’s essential to choose a vehicle you can comfortably afford both now and in the future.

10. Manage Your Account Responsibly: Once you’ve secured financing, manage your Toyota Finance account responsibly. Make payments on time and in full to avoid late fees, penalties, and negative marks on your credit report. Set up automatic payments or reminders to ensure you never miss a payment.

11. Plan for the Future: Consider how your vehicle financing fits into your long-term financial goals. Think about how owning or leasing a car will impact your budget, savings, and overall financial health. Plan for future expenses such as maintenance, repairs, and potential upgrades.

In conclusion, Toyota Finance offers a wide range of benefits and advantages for consumers, including flexible financing options, leasing programs, and insurance coverage. With competitive interest rates and transparent pricing, Toyota Finance ensures that customers can find the right financing package to fit their budget and needs.

Additionally, the application process is straightforward, whether done in person or online, it allows consumers to secure financing for their vehicle purchase. By following these step-by-step guides, you can navigate the application process with ease and confidence, ensuring a seamless and hassle-free experience from start to finish.

Also, Toyota Finance makes vehicle ownership accessible and affordable, providing customers with peace of mind and confidence as they drive off in their new Toyota vehicle. Using Toyota Finance effectively requires careful planning, research, and responsible financial management.

By assessing your financial situation, setting a realistic budget, understanding your financing options, and negotiating the terms of your financing, you can make informed decisions and secure a financing arrangement that works for you.

Remember to read and understand the fine print, choose the right vehicle, and manage your account responsibly to ensure a successful financing experience. With these tips in mind, you can make the most of Toyota Finance and enjoy the benefits of owning or leasing a Toyota vehicle.