YOUR CART

- No products in the cart.

Subtotal:

$0.00

BEST SELLING PRODUCTS

VEVOR 1500W Electric Chicken Plucker Plucking Machine 20 Inch Heavy Duty Duck Birds Turkey De-Feather Remover Poultry Machine

$1,310.97 – $1,573.17

VEVOR 1500W Electric Chicken Plucker Plucking Machine 20 Inch Heavy Duty Duck Birds Turkey De-Feather Remover Poultry Machine

$1,310.97 – $1,573.17

VEVOR Large Metal Chicken Coop Poultry Cage Duck Rabbit Walkin Dome Roof with Waterproof Cover for Farm Pet Yard Hen House

$869.97 – $1,670.97

VEVOR Large Metal Chicken Coop Poultry Cage Duck Rabbit Walkin Dome Roof with Waterproof Cover for Farm Pet Yard Hen House

$869.97 – $1,670.97

VEVOR Large Metal Chicken Coop with Waterproof Cover Dome Roof Poultry Cage for Hen House Yard Duck Walkin Coop and Rabbit Run

$478.77 – $2,814.96

VEVOR Large Metal Chicken Coop with Waterproof Cover Dome Roof Poultry Cage for Hen House Yard Duck Walkin Coop and Rabbit Run

$478.77 – $2,814.96

VEVOR Automatic Chicken Coop Door Opener Cage Closer Timer Light Sensor Brown/Gray/Red Backyard Poultry Supplies Pet Supplies

$282.12 – $462.00

VEVOR Automatic Chicken Coop Door Opener Cage Closer Timer Light Sensor Brown/Gray/Red Backyard Poultry Supplies Pet Supplies

$282.12 – $462.00

9/15/24/30 Brooder Eggs Incubator Fully Automatic for Chicken Goose Quail Auto Turner Equipment Hatchery Poultry Tools

$132.81 – $327.51

9/15/24/30 Brooder Eggs Incubator Fully Automatic for Chicken Goose Quail Auto Turner Equipment Hatchery Poultry Tools

$132.81 – $327.51

ATUBAN Automatic Chicken Coop Door,Aluminum Weatherproof Coops Door Opener with Timer,Locking Auto Chicken Doors for Home & Farm

$115.98 – $246.75

ATUBAN Automatic Chicken Coop Door,Aluminum Weatherproof Coops Door Opener with Timer,Locking Auto Chicken Doors for Home & Farm

$115.98 – $246.75

500 Pcs Poultry Chicken Nipple Drinker Automatic Waters Spring Type Drinking Fountain Mouth Water Poultry Farming Equipment

$106.72

500 Pcs Poultry Chicken Nipple Drinker Automatic Waters Spring Type Drinking Fountain Mouth Water Poultry Farming Equipment

$106.72

50 pcs 9.5 cm Poultry Plucking Fingers Hair Removal Machine Glue Stick Chicken Plucker Beef tendon material corn rod

$79.38

50 pcs 9.5 cm Poultry Plucking Fingers Hair Removal Machine Glue Stick Chicken Plucker Beef tendon material corn rod

$79.38

Buy your Hybrid Date Seedlings

Buy your Hybrid Date Seedlings

Tactical Police Dog Collar Military Adjustable Duarable Nylon German Shepard For Medium Large Walking Training Pet Accessories

$4.96

Tactical Police Dog Collar Military Adjustable Duarable Nylon German Shepard For Medium Large Walking Training Pet Accessories

$4.96

1PC 12/18holes Double Row Plastic Flip-Top Poultry Bird Feeder Ground Chicken Bird Feeder Trough Pheasant Feeding Bucket

$10.11 – $12.06

1PC 12/18holes Double Row Plastic Flip-Top Poultry Bird Feeder Ground Chicken Bird Feeder Trough Pheasant Feeding Bucket

$10.11 – $12.06

Comprehensive Plantain and Banana Farming Guide

Comprehensive Plantain and Banana Farming Guide

How To Start And Operate A Successful Catfish Farming Business For Profits

How To Start And Operate A Successful Catfish Farming Business For Profits

Artificial Fluffy Pampas Grass Bouquet 5/10/20/pc Wedding Party Decoration Boho Fake Plant Flower for DIY Room Home Decor Flower

$2.97

Artificial Fluffy Pampas Grass Bouquet 5/10/20/pc Wedding Party Decoration Boho Fake Plant Flower for DIY Room Home Decor Flower

$2.97

Chicken Duck Drinking Cup Automatic Drinker Chicken Feeder Plastic Poultry Farm Water Drinking Cups Water Feeder for Goose Quail

$4.96

Chicken Duck Drinking Cup Automatic Drinker Chicken Feeder Plastic Poultry Farm Water Drinking Cups Water Feeder for Goose Quail

$4.96

Buy your Grafted Hybrid Wambugu Apple Seedlings

Buy your Grafted Hybrid Wambugu Apple Seedlings

Complete Practical Guide on Garri Processing

Complete Practical Guide on Garri Processing

Complete Steps on How to Hatch and Care for Tilapia Fishes for Profits

Complete Steps on How to Hatch and Care for Tilapia Fishes for Profits

Complete Practical Guide on Cassava Flour Processing

Complete Practical Guide on Cassava Flour Processing

Complete Practical Guide on Yam Flour Processing

Complete Practical Guide on Yam Flour Processing

6-36Pcs Chicken Duck Drinking Cup Automatic Drinker Chicken Feeder Plastic Poultry Farm Water Drinking Cups Easy Installation

$4.96 – $34.06

6-36Pcs Chicken Duck Drinking Cup Automatic Drinker Chicken Feeder Plastic Poultry Farm Water Drinking Cups Easy Installation

$4.96 – $34.06

Poultry Feeders Plastic 1.5Kg Reusable Chick Hen Quail Pigeon Feeding Watering Tool Farm Animal Supplies

$4.96

Poultry Feeders Plastic 1.5Kg Reusable Chick Hen Quail Pigeon Feeding Watering Tool Farm Animal Supplies

$4.96

5/10PCS Automatic Chicken Water Feeder Drinking Cups Poultry Kit for Chicks Duck Goose Turkey Quail Feeding & Watering Supplie

$12.66 – $15.60

5/10PCS Automatic Chicken Water Feeder Drinking Cups Poultry Kit for Chicks Duck Goose Turkey Quail Feeding & Watering Supplie

$12.66 – $15.60

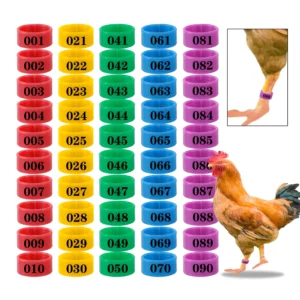

1.6/1.8/2.0cm 001~100 Chicken Foot Ring Turkeys Quail Foot Ring Easy Install & Remove Manually Poultry Carry Foot Ring 100 Pcs

$4.96

1.6/1.8/2.0cm 001~100 Chicken Foot Ring Turkeys Quail Foot Ring Easy Install & Remove Manually Poultry Carry Foot Ring 100 Pcs

$4.96

VEVOR Large Metal Chicken Coop with Waterproof Cover Dome Roof Poultry Cage for Hen House Yard Duck Walkin Coop and Rabbit Run

$478.77 – $2,814.96

VEVOR Large Metal Chicken Coop with Waterproof Cover Dome Roof Poultry Cage for Hen House Yard Duck Walkin Coop and Rabbit Run

$478.77 – $2,814.96

Comprehensive Plantain and Banana Farming Guide

Comprehensive Plantain and Banana Farming Guide

Comprehensive Poultry Farming Guide

Comprehensive Poultry Farming Guide

Comprehensive Pig Farming Guide

Comprehensive Pig Farming Guide

Comprehensive Snail Farming Guide

Comprehensive Snail Farming Guide

Comprehensive Yam Farming Guide

Comprehensive Yam Farming Guide

Comprehensive Plantain and Banana Farming Guide

Comprehensive Plantain and Banana Farming Guide

Comprehensive Poultry Farming Guide

Comprehensive Poultry Farming Guide

Comprehensive Pig Farming Guide

Comprehensive Pig Farming Guide

Comprehensive Snail Farming Guide

Comprehensive Snail Farming Guide

Comprehensive Yam Farming Guide

Comprehensive Yam Farming Guide