The cost of goods sold is a fundamental concept in accounting and financial management, especially for businesses involved in the production or sale of goods. It represents the direct costs attributable to the production of the goods sold by a company during a specific period.

Calculating cost of goods sold accurately is crucial for determining the profitability of a business and for preparing financial statements such as the income statement and making informed pricing decisions, and managing inventory effectively. It directly impacts various financial ratios and performance indicators, including gross profit margin, inventory turnover, and net income.

Furthermore, cost of goods sold plays a crucial role in determining the overall profitability of a company and influences strategic decision-making processes. Financial analysts and stakeholders often rely on cost of goods sold data to evaluate a company’s performance relative to its industry peers and historical performance.

In addition to the cost of goods sold it is a direct expenses incurred in producing goods or services sold by a business during a specific accounting period. It is classified as an expense account in the income statement of a company. These expenses typically include the cost of materials, labor, and overhead directly attributable to production.

It is often listed separately from other operating expenses to highlight its significance in determining gross profit. As an expense account, cost of goods sold reflects the direct costs incurred in the production of goods or services and is essential for assessing the profitability of the core business activities.

Read Also: How to Choose The Right Marketplace Insurance Plan

Various Methods of Calculating the Cost of Goods Sold

Cost of Goods Sold is a critical financial metric that measures the direct expenses incurred in producing goods or services sold by a business. Calculating cost of goods sold accurately is essential for assessing profitability, making informed pricing decisions, and managing inventory effectively.

1. FIFO (First-In, First-Out): Under the FIFO method, the cost of goods sold is calculated based on the assumption that the oldest inventory items are sold first. This means that the cost of goods sold reflects the cost of the earliest inventory purchases, while the ending inventory consists of the most recently acquired items.

FIFO is suitable for businesses with perishable goods or those facing rising inventory costs over time. It aligns with the natural flow of inventory and may result in lower taxable income during periods of inflation due to the higher valuation of ending inventory.

2. LIFO (Last-In, First-Out): Contrary to FIFO, the LIFO method assumes that the most recently acquired inventory items are sold first. This means that the cost of goods sold reflects the cost of the latest inventory purchases, while the ending inventory consists of the oldest items.

LIFO is beneficial during periods of inflation, as it results in a higher cost of goods sold and lower taxable income compared to FIFO. However, LIFO may not accurately reflect the physical flow of inventory and can lead to inventory obsolescence issues.

3. Weighted Average Cost: The weighted average cost method calculates the average cost of all units available for sale during the accounting period. This is achieved by dividing the total cost of goods available for sale by the total number of units available for sale.

The weighted average cost per unit is then multiplied by the number of units sold to determine the cost of goods sold. This method is straightforward and suitable for businesses with homogeneous inventory items. It smoothens out fluctuations in inventory costs and provides a consistent cost basis for inventory valuation and cost of goods sold calculation.

4. Specific Identification: Under the specific identification method, the actual cost of each inventory item sold is individually tracked and matched with its corresponding sale. This method is particularly useful for businesses dealing with high-value or unique inventory items, such as luxury goods or customized products.

While specific identification provides the most accurate reflection of inventory costs, it can be administratively burdensome and may not be practical for businesses with large inventories or frequent inventory turnover.

5. Retail Method: The retail method is commonly used by retail businesses to estimate the cost of goods sold based on the ratio of cost to retail price. This method involves calculating the cost-to-retail ratio by dividing the total cost of goods available for sale by the total retail value of goods available for sale.

The cost of goods sold is then estimated by applying this ratio to the total retail sales during the accounting period. The retail method is simple to apply and suitable for businesses with diverse product lines and fluctuating inventory costs.

6.Consistency: Consistency in accounting practices is critical for accurate cost of goods sold calculation and financial reporting. Businesses should adhere to consistent methods and assumptions across accounting periods to facilitate comparability and ensure reliability of financial statements.

7. Accrual Basis Accounting: Cost of goods sold is typically calculated using the accrual basis of accounting, which recognizes revenues and expenses when they are incurred, regardless of when cash is exchanged. This ensures that cost of goods sold reflects the economic reality of production activities and sales transactions during the accounting period.

Read Also: Reasons Why You Should Venture Into Affiliate Marketing

Guide to Calculating Cost of Goods Sold

Calculating the Cost of Goods Sold cost of goods sold is a fundamental aspect of financial management for businesses across various industries. It involves determining the direct expenses incurred in producing goods or services sold during a specific accounting period.

1. Determine Beginning Inventory: The first step in calculating cost of goods sold is to identify the value of inventory on hand at the beginning of the accounting period. This includes both finished goods ready for sale and raw materials or components used in production. Beginning inventory serves as the starting point for tracking the flow of inventory and assessing the cost of goods sold during the period.

2. Add Purchases: Next, include the cost of all inventory purchases made during the accounting period. This encompasses both direct materials used in production and additional components necessary for manufacturing goods. It’s essential to accurately record the cost of purchases, including any discounts, freight charges, or other related expenses incurred in acquiring inventory.

3. Calculate Ending Inventory: Determine the value of inventory remaining at the end of the accounting period. This can be accomplished through physical counts or using inventory management systems that track inventory levels in real-time. Ending inventory represents the value of goods not yet sold and serves as the basis for determining the cost of goods sold during the period.

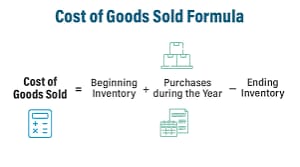

4. Subtract Ending Inventory from Beginning Inventory and Purchases: The final step in calculating cost of goods sold is to subtract the value of ending inventory from the sum of beginning inventory and inventory purchases. The formula for calculating cost of goods sold is as follows: Cost of goods sold = Beginning Inventory + Purchases – Ending Inventory.This equation yields the total cost of goods sold during the period, representing the direct expenses incurred in producing the goods or services sold by the business.

The Formula For Calculating Cost of Goods Sold

The formula for calculating the Cost of Goods Sold is: Cost of goods sold = {Beginning Inventory} + {Purchases} – {Ending Inventory}

Here is an example to illustrate the calculation of the cost of goods sold: Suppose you run a bakery, and you want to calculate the cost of goods sold for January. Here is the relevant information:

- Beginning Inventory (January 1st): $5,000

- Purchases of ingredients and supplies during January: $3,000

- Ending Inventory (January 31st): $2,000

Using the cost of good sold formula, we can calculate:

Cost of goods sold= $5,000 + $3,000 – $2,000

Cost of goods sold= $6,000

So, the Cost of Goods Sold for your bakery in January is $6,000. This represents the total cost incurred by your bakery to produce the goods that were sold during the month.

The Impact of Calculating Cost of Goods Sold On Profitability

1. Gross Profit Margin: Cost of goods sold is subtracted from total revenue to calculate gross profit. A higher cost of goods sold relative to revenue results in a lower gross profit margin, indicating reduced profitability. Conversely, lowering the cost of goods sold or increasing revenue can improve gross profit margin and profitability.

2. Net Income: After deducting operating expenses from gross profit, the cost of goods sold contributes to determining net income. Higher cost of goods sold reduces net income, while lower cost of goods sold increases net income, directly impacting the bottom line and overall profitability of the business.

3. Competitive Pricing: The cost of goods sold influences pricing decisions, as businesses must factor production costs into their pricing strategies to ensure profitability. Effective management of the cost of goods sold allows businesses to offer competitive prices while maintaining healthy profit margins, enhancing market competitiveness and profitability.

4. Investor Perception: Investors and stakeholders analyze cost of goods sold data as part of financial analysis to assess a company’s profitability and operational efficiency. A high cost of goods sold relative to revenue may raise concerns about cost management and efficiency, potentially impacting investor confidence and shareholder value.

Read Also: Potato Farming Guide – 7 Tips to Grow Sacks Full of Potatoes